Our best spreads and conditions

About platform

About platform

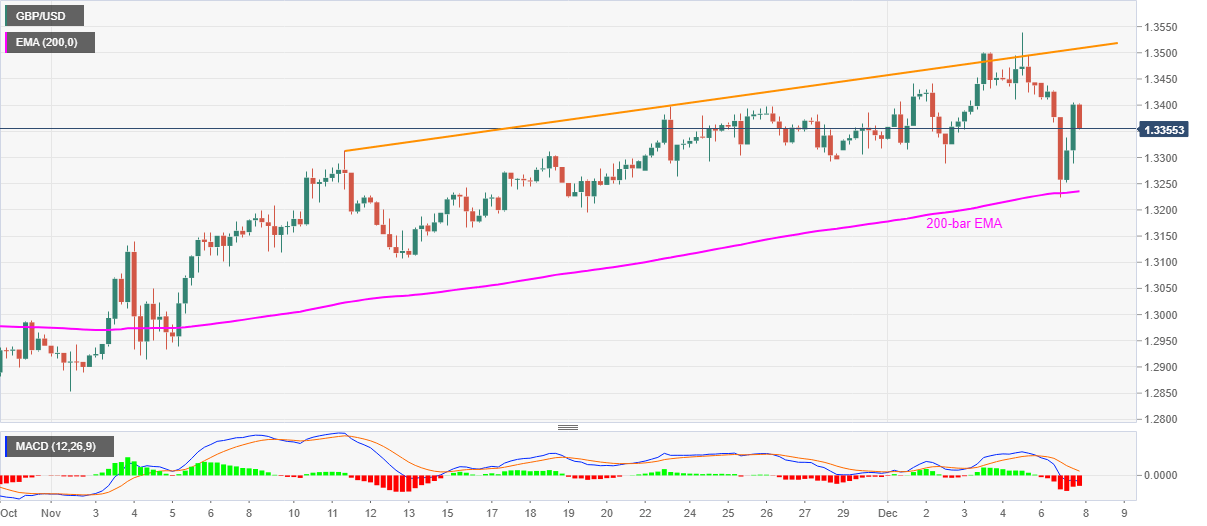

GBP/USD drops to 1.3354, down 0.18% intraday, amid the early Asian trading on Tuesday. The cable slumped to the lowest since November 19 the previous day before bouncing off 1.3224.

However, failures to keep the corrective bounce join bearish MACD to keep the GBP/USD sellers hopeful.

Hence, the current selling pressure eyes re-test of the 200-bar EMA, near 1.3230 now. Though, any further downside will not hesitate to challenge November 12 low close to the 1.3100 round-figure.

Alternatively, the 1.3400 threshold and 1.3430 can offer immediate upside barriers to the pair’s fresh recovery moves.

Also acting as resistance will be the ascending trend line from November 11, currently around 1.3510.

Trend: Further weakness expected