NZD/USD bulls need bears to step away at 0.7060

- Risk sentiment is fragile and a potential weight for the higher beta currencies such as the kiwi.

- NZD/USD is forming a toppish outlook on the longer-term charts.

NZD/USD is trading at 0.7042 between a low of 0.7005 and a high of 0.7064, higher by some 11% on the day approaching the bell on Wall Street.

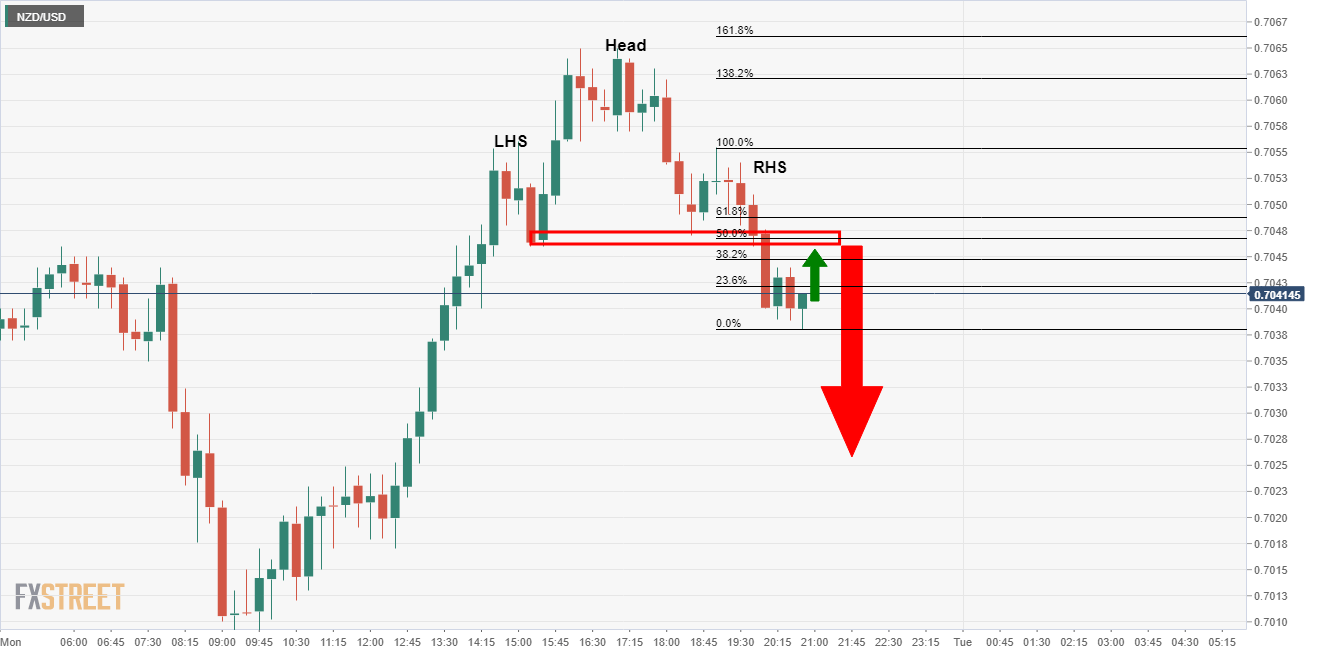

We saw the usual London breakout and typical New York correction back to the mean on Monday.

There is little on the domestic front for the bird and focus will, instead, be concentrated on European and US macro for the week ahead with US stimulus negotiations and UK-EU trade talks on the brink.

''That leaves kiwi vulnerable to a sudden change in mood,'' analysts at ANZ Bank argued.

''And although we see NZD gradually grinding higher in time, getting gains may be a struggle in the short-term as global events cast a shadow.''

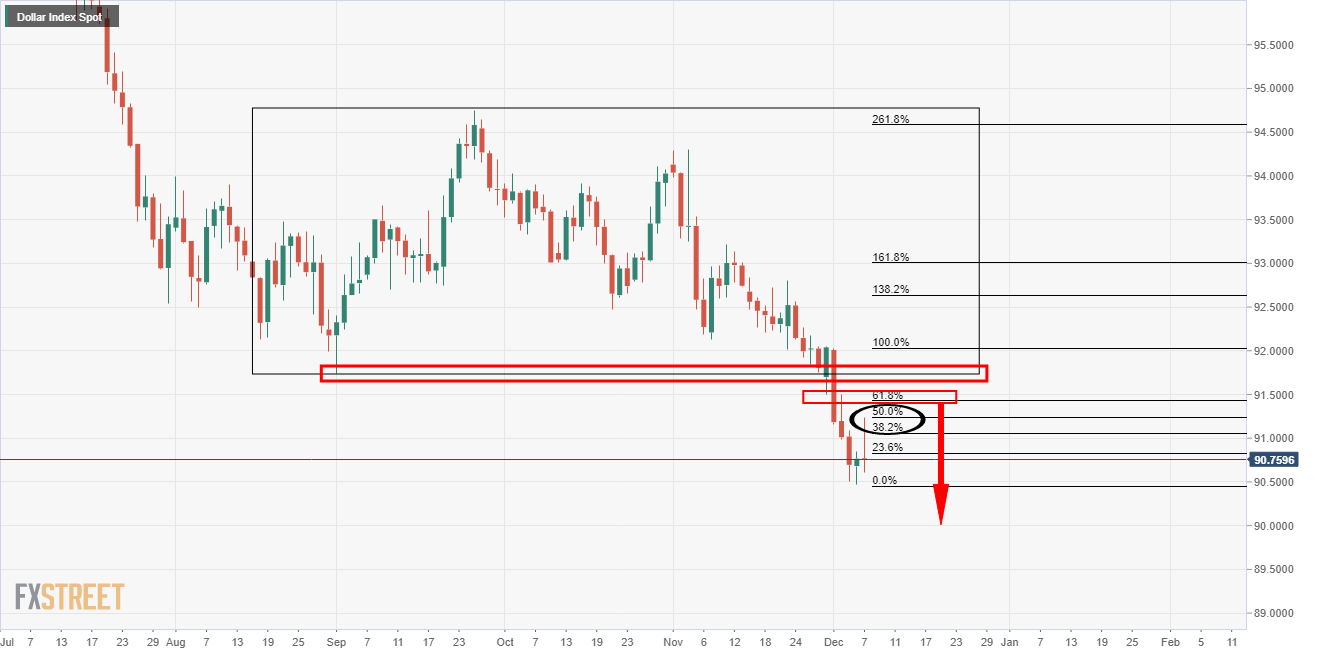

For the greenback, negotiations over a new pandemic package as well as the prospects of a vaccine have overshadowed the risks of the current wave of COVID-19 infections and disappointing labour market data.

Despite the poor data, however, the US dollar has been attempting to stabilise and correct the recent bearish impulse.

While pressures are mounted to the downside, the greenback, from a technical perspective, could be expected to correct with a wider footprint on the daily chart at this juncture.

Much from here will depend on the Federal Reserve meeting later this month as well as US Lawmakers that expected to have until 18 December to agree on new emergency support.

A deal appears widely expected in markets which should maintain pressures on the greenback and help lift higher-beta currencies, such as the kiwi, on risk appetite.

''Agreeing compatible content and language to garner the necessary political support is a work in progress at present,'' analysts at ANZ bank argued.

Elsewhere, additional macro risk factors stay with the UK-EU trade talks appearing to be on the brink of collapse and the US has also imposed sanctions on 14 new officials over China’s treatment of dissent in Hong Kong.

Neither of these bodes particularly well for risk sentiment nor the kiwi.

NZD/USD technical analysis

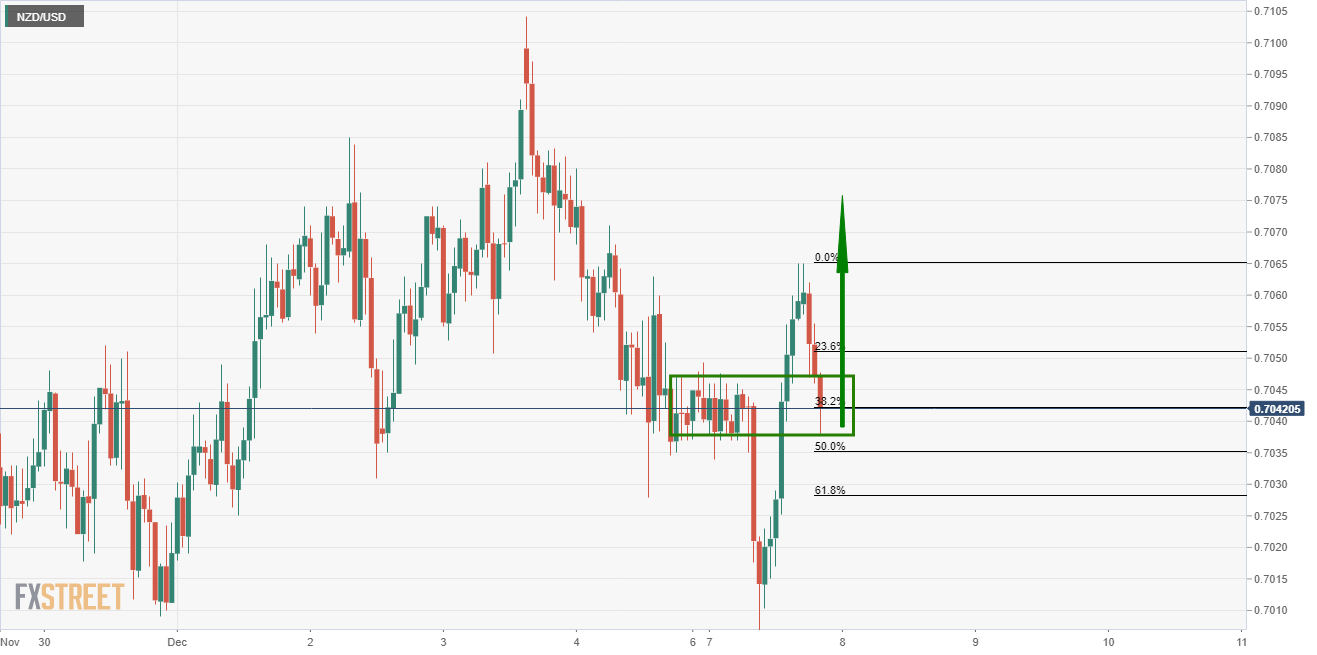

In the start of the week's analysis, NZD/USD Price Analysis: Bulls on top above daily support, it was argued that while the price has been in a strong rally through weekly/daily resistance, it could be due a healthy correction.

From an hourly perspective, the price has corrected the bullish impulse and could be expected to now extend the bullish trend.

However, the 15 min time frame paints another story:

There will only be a short-term bullish bias once the price gets above the shoulders at 0.7060.