Back

19 Oct 2020

Natural Gas Futures: Neutral/Bearish outlook remains unchanged

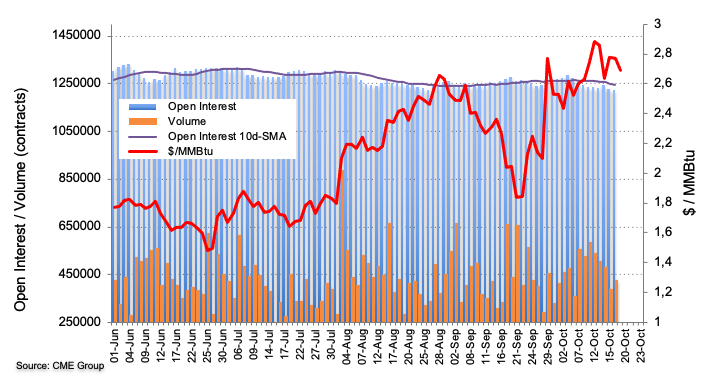

Investors reduced their open interest positions for the second consecutive session on Friday, now by around 2.3K contracts according to advanced figures from CME Group. Volume, instead, reversed four consecutive sessions and rose by nearly 37.2K contracts.

Natural Gas faces further consolidation

Prices of Natural Gas charted and inconclusive session on Friday amidst shrinking open interest and rising volume. Against this, further consolidation appears on the cards, while a breakout of this theme should face the next hurdle at the $3.00 mark per MMBtu in the near-term.