Our best spreads and conditions

About platform

About platform

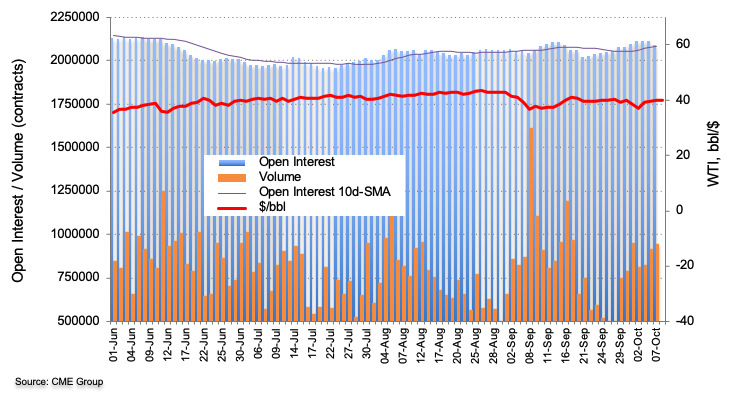

Traders trimmed their open interest positions by around 19.3K contracts on Wednesday in light of preliminary readings from CME Group. Volume, instead, went up for the third consecutive session, this time by almost 32K contracts.

Prices of the West Texas Intermediate rose for the third straight session on Wednesday. The uptick, however, was in tandem with shrinking open interest, leaving the likelihood of further upside somewhat curtailed. That said, the $41.50 region (high September 18) still emerges as a key barrier on the upside.