Gold Price Analysis: XAU/USD path of least resistance is up after Lagarde – Confluence Detector

Gold has been extending its gains – this time seemingly supported by the European Central Bank. Optimism from the Frankfurt-based institution – allowing the euro to rise – has pushed other assets higher, including the precious metal. XAU/USD is changing hands at around $1,960.

US stocks are also on the move, extending their recovery from a downfall earlier in the week. Gold seems to be more and more correlated with equities.

How is XAU/USD technically positioned?

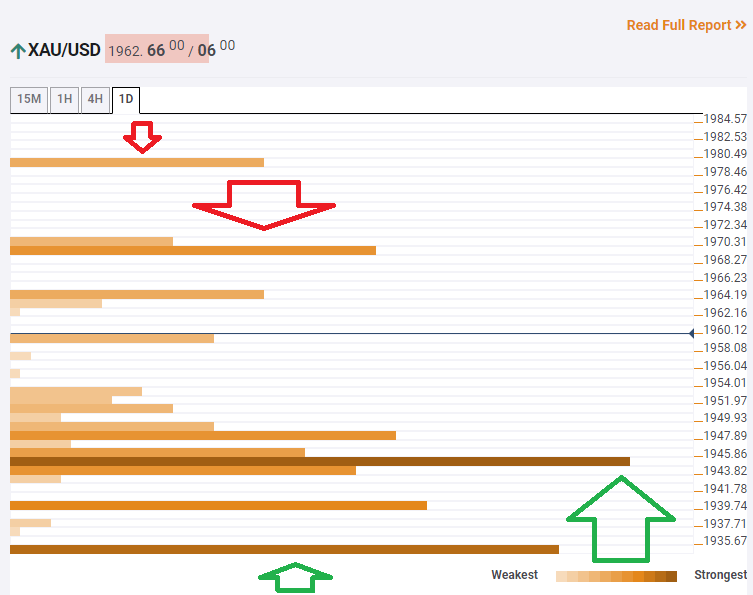

The Technical Confluences Indicator is showing that gold has substantial support at around $1,944, which is the convergence of the Fibonacci 38.2% one-month, the Simple Moving Average 50-4h, the SMA 100-4h, and the Fibonacci 23.6% one-day.

Another cushion awaits at $1,934, which is a meeting point including the Bollinger Band 4h-Middle, the SMA 100-1h, the Fibonacci 23.6% one-week, and the SMA 5-one-day.

Looking up, resistance is at $1,969, which is where the Pivot Point one-day Resistance 2 hits the price.

Higher, $1,979 is the upside target, where the PP one-week R1 awaits XAU/USD.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Learn more about Technical Confluence