USD/JPY Price Analysis: Bulls struggle to regain 106.18 barrier

- USD/JPY attempts a bounce but faces stiff resistance.

- 50-HMA guards the downside amid risk-on mood.

- Hourly RSI remains bearish, bounce to remain short-lived?

USD/JPY is looking to extend the bounce from a daily low of 106.05, as the bulls cheer the risk-on market environment.

With hopes over the coronavirus vaccine still alive and increasing expectations of the US stimulus deal, the market mood remains upbeat and fuels the bounce in the S&P 500 futures and Treasury yields.

However, the reduced haven demand for the US dollar keeps a check on USD/JPY’s upside attempts.

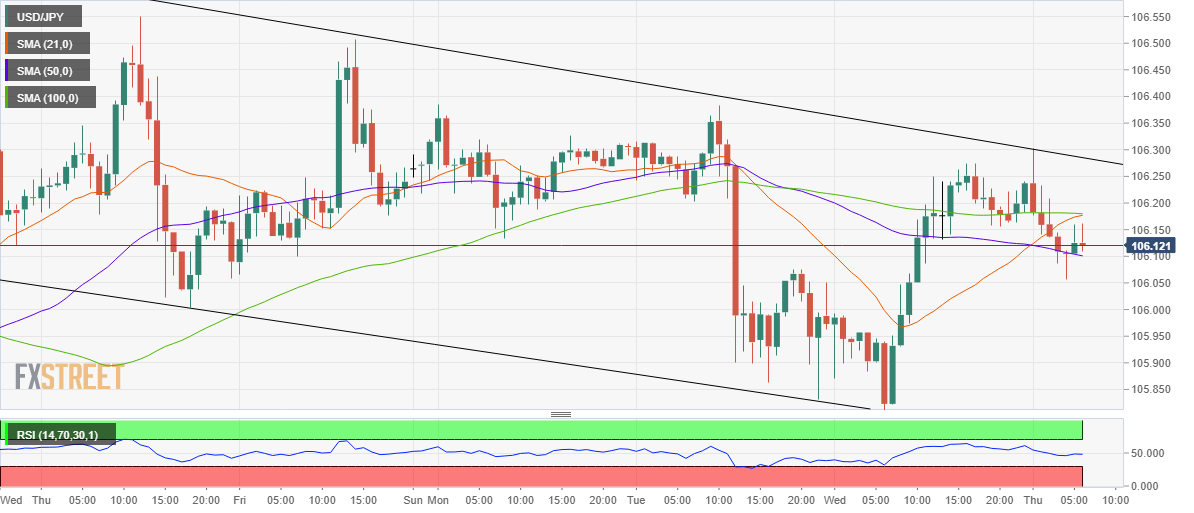

From a near-term technical perspective, the spot reversed a dip below the 50-hourly Simple Moving Average (HMA) at 106.10.

The pullback, however, is likely to meet fresh supply at 106.18, the confluence of the bullish 21-HMA and horizontal 100-HMA.

Only a decisive break above the latter will revive the recovery momentum, calling for a test of the falling trendline resistance at 106.28.

Meanwhile, an hourly close below the 50-HMA could trigger a fresh sell-off, with the 106 level likely to be put at risk. Acceptance below the last could expose Wednesday’s low of 106.82.

The Relative Strength Index (RSI) on the hourly chart has turned south while trading below the midline, currently at 47.30, allowing for more declines.

USD/JPY: Hourly chart

USD/JPY: Additional levels