Back

10 Sep 2020

Gold Futures: Scope for extra gains

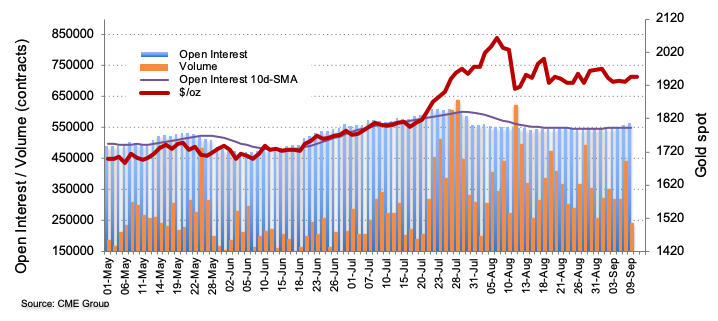

Traders increased their open interest positions for the third session in a row on Wednesday, this time by around 8.1K contracts according to advanced figures from CME Group. Volume, instead, reversed two consecutive builds and shrunk by nearly 199K contracts.

Gold still targets $2,000/oz

Prices of the ounce troy of gold keep the side-line theme unchanged above the $1,900 mark so far. Wednesday’s positive performance of the yellow metal was accompanied by rising open interest, which is indicative that extra gains are likely in the short-term horizon.