Back

7 Sep 2020

Natural Gas Futures: Potential correction on the cards

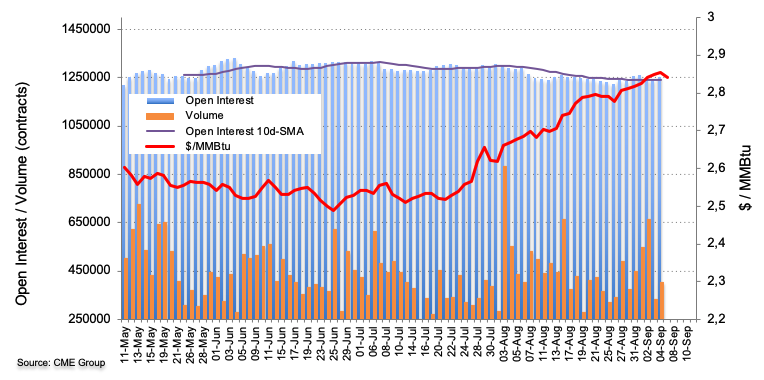

Advanced readings from CME Group for Natural Gas futures markets noted investors increased their open interest positions by almost 12K contracts on Friday. Volume followed suit and partially reversed the previous drop and went up by nearly 72K contracts.

Natural Gas recedes from 2020 tops

Prices of Natural Gas clinched fresh tops around $2.87 MMBtu on Friday before receding and close around the $2.85 area. The move was accompanied by rising open interest and volume, opening the door to a deeper knee-jerk in the short-term horizon.