Gold Price Analysis: XAU/USD pierces $1,940 on the break of immediate falling channel

- Gold prices pick-up bids after multiple bounces off $1,930.

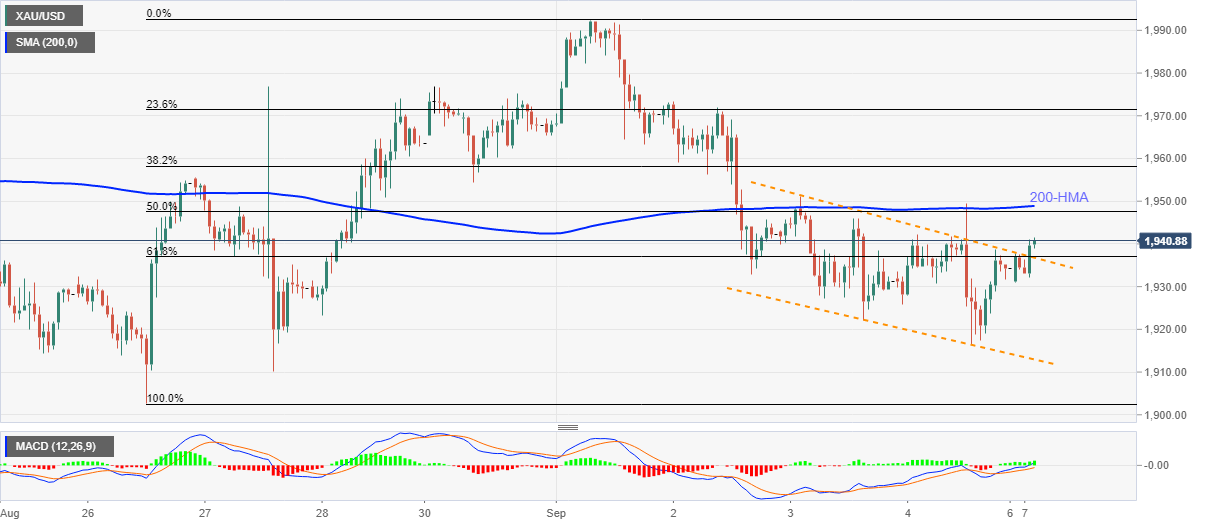

- 200-HMA, 50% Fibonacci retracement guard immediate upside amid bullish MACD.

- Sellers will have multiple supports challenging further weakness before $1,900.

Gold prices rise to $1,940.52, up 0.28% on a day, during the early Monday. The bullion recently flashed the intraday high of $1,940.98 after breaking a downward sloping trend channel formation from Thursday. The up-move also gains support from bullish MACD.

As a result, the quote’s run-up to 200-HMA and 50% Fibonacci retracement of August 26 to September 01 upside, near $,1947/49, is more likely.

However, a sustained break of $1,949, also clearing the $1,950 round-figures, will enable the bulls to challenge the $1,977 and $2,000 psychological benchmark.

Alternatively, the commodity’s downside break of the channel’s upper line, at $1,936, will be followed by $1,930 to challenge the short-term declines.

During the quote’s further weakness past-$1,930, the channel’s support line near $1,912 and August 27 low around $1,910 may offer intermediate halts ahead of recalling $1,900 on the charts.

Gold hourly chart

Trend: Further recovery expected