Back

21 Jul 2020

Natural Gas Futures: Rebound could extend further

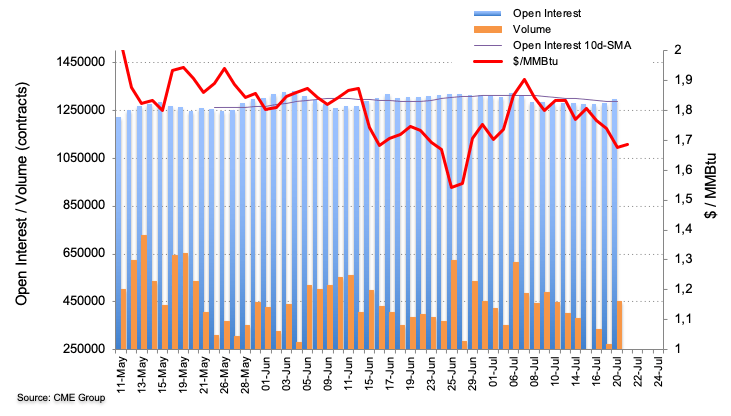

Open interest in Natural Gas futures markets increased for the second session in a row on Monday, this time by around 16.1K contracts according to advanced readings from CME Group. In the same line, volume rose sharply by almost 179K contracts, offsetting the previous build.

Natural Gas met support near $1,64/MMBtu

Monday’s drop in Natural Gas and rebound from the vicinity of $1,64 per MMBtu was amidst rising increasing open interest and volume, allowing for the probable continuation of the bull run to, initially, the $1,811/$1,823 band, where converge the 55-day and 100-day SMAs.