Our best spreads and conditions

About platform

About platform

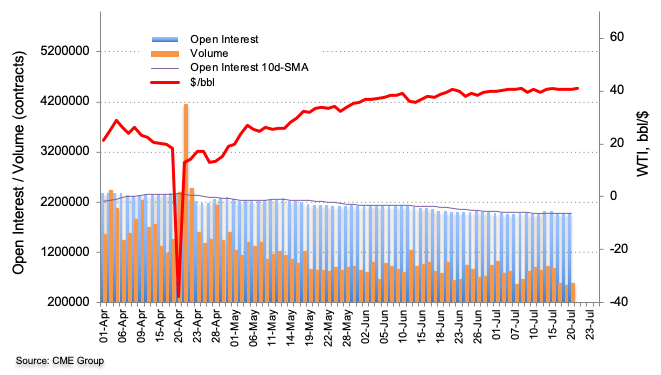

In light of preliminary figures from CME Group, traders scaled back their open interest positions for the fourth session in a row on Monday, now by almost 5.3K contracts. Volume, instead, reversed three straight pullbacks and advanced by nearly 40K contracts.

Prices of the barrel of WTI are extending the consolidative mood around the $40.00/$41.00 mark. Inconclusive performance of both open interest and volume is seen keeping the side-lined theme unaltered for the time being. In addition, the key 200-day SMA at $43.45 continues to cap occasional bullish attempts.