USD/INR Price News: Indian rupee bulls catch a breather around two-week low under 75.00

- USD/INR attempts recovery from 74.72, the lowest since July 07.

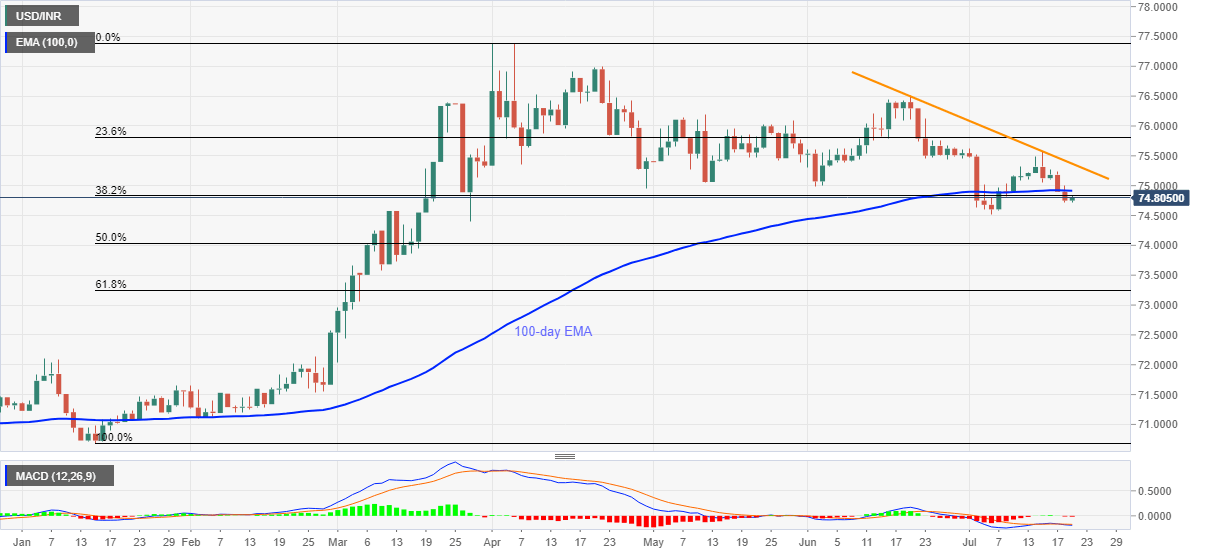

- 38.2% Fibonacci retracement, 100-day EMA can question the bulls amid bearish MACD.

- Sellers may aim to refresh monthly low during further weakness.

USD/INR struggles to extend the previous fall while taking rounds to 74.80 during the initial Indian session. The pair consolidates near the lowest in two weeks after slipping below 100-day EMA. Also keeping the bears hopeful is the MACD conditions and the quote’s declines below 38.2% Fibonacci retracement level of January-April upside.

Hence, the traders are watching over July month low of 74.52 during further weakness. Though, 50% Fibonacci retracement level of 74.04 and 74.00 round-figures might probe the extra south-run.

In a case where the pair keeps declining past-74.00, March 11 low near 73.58 and 61.8% Fibonacci retracement level of 73.25 will return to the charts.

On the contrary, a daily closing beyond 100-day EMA level of 74.91 will have to cross a falling trend line from June 19, at 75.37 to regain the bulls’ confidence.

USD/INR daily chart

Trend: Bearish