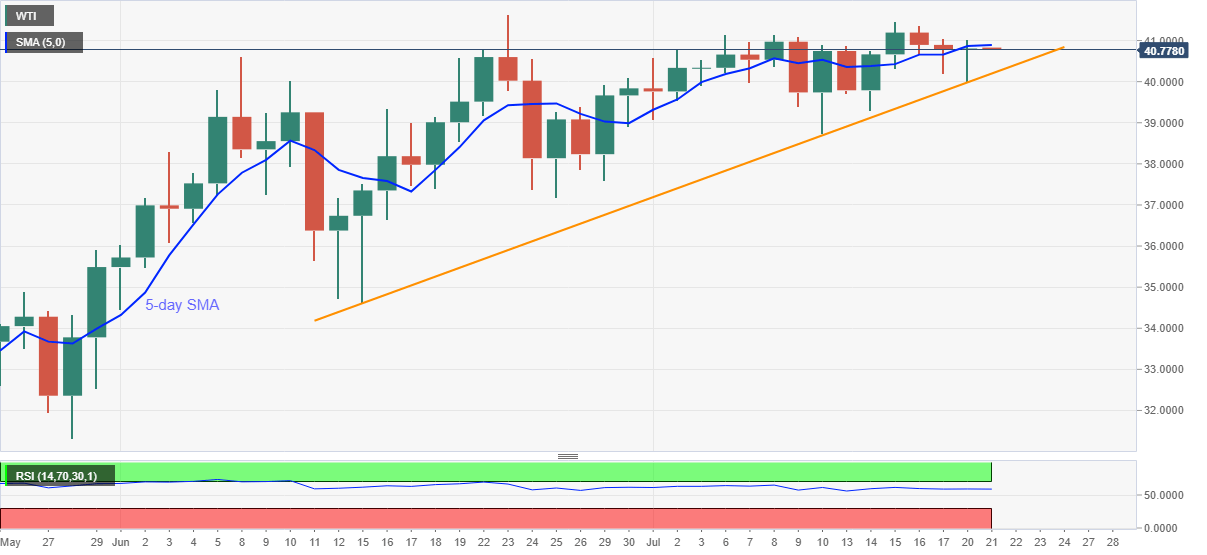

WTI Price Analysis: Break of 5-day SMA fails to disappoint buyers above $40.00

- WTI extends pullback from the monthly high flashed last Wednesday.

- Bears await a clear break below five-week-old support line.

- Buyers can add positions beyond $41.00 with June month top on the radar.

WTI remains on the back foot around $40.77 during the early Asian session on Tuesday. With this, the energy benchmark remains below 5-day SMA and indicates further weakness after flashing negative closings in the last three days. However, an upward sloping trend line from June 15 restricts the immediate downside of the black gold.

As a result, the sellers are waiting for entries below $40.00 to target the monthly bottom around $38.70 and the late-June low near $37.20.

Additionally, $39.00 and June month’s bottom surrounding $34.50 could act as extra levels to watch during the quote’s further weakness.

On the contrary, the oil price strength above 5-day SMA level of $40.8 needs validation from $41.00 to challenge the current month’s high near $41.45 and aim for June month’s top close to $41.65.

In a case where the bulls remain dominant past-$41.65, February month’s low around $44.00.

WTI daily chart

Trend: Pullback expected