Back

20 Jul 2020

Crude Oil Futures: Downside seen limited

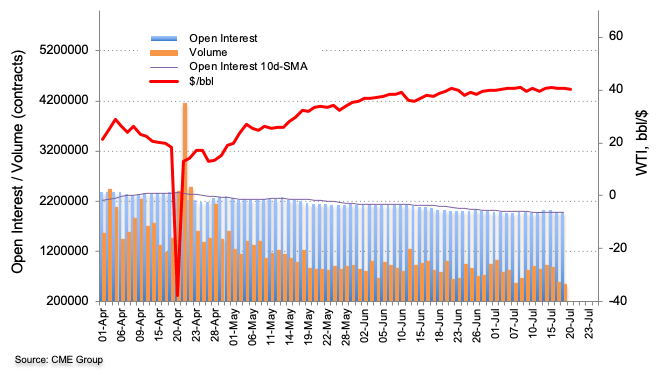

Investors trimmed their open interest positions for the third consecutive session at the end of last week, now by nearly 9.5K contracts according to advanced readings from CME Group. In the same line, volume shrunk for the third session in a row, this time by around 40.6K contracts.

WTI still navigates below the 200-day SMA

Prices of the barrel of WTI are prolonging the side-lined theme for yet another session. Friday’s small downtick was accompanied by shrinking open interest and volume, hinting at the idea that deeper pullbacks look unlikely, at least in the short-term horizon. On the upside, the initial target remains at the 200-day SMA, today near $43.50.