Back

14 Jul 2020

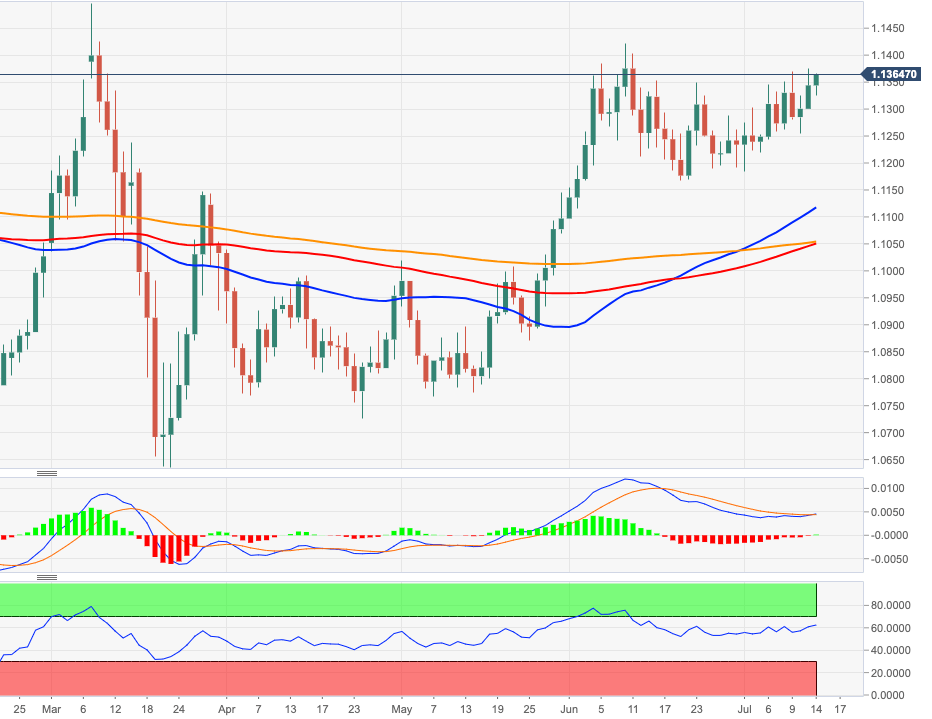

EUR/USD Price Analysis: A test of 1.1420 appears closer

- EUR/USD keeps the firm note in the 1.1365/70 band on Tuesday.

- A move north should see the 1.14 neighbourhood revisited.

EUR/USD is prolonging the rebound from Friday’s lows near 1.1250, managing well to retake last week’s tops in the 1.1370/80 band.

If the buying bias picks up pace, there is increasing chances of a move to the 1.1400 barrier ahead of June’s high at 1.1422.

Further out, as long as the 200-day SMA, today at 1.1050, holds the downside, further gains in EUR/USD remains well on the table.

EUR/USD daily chart