Back

14 Jul 2020

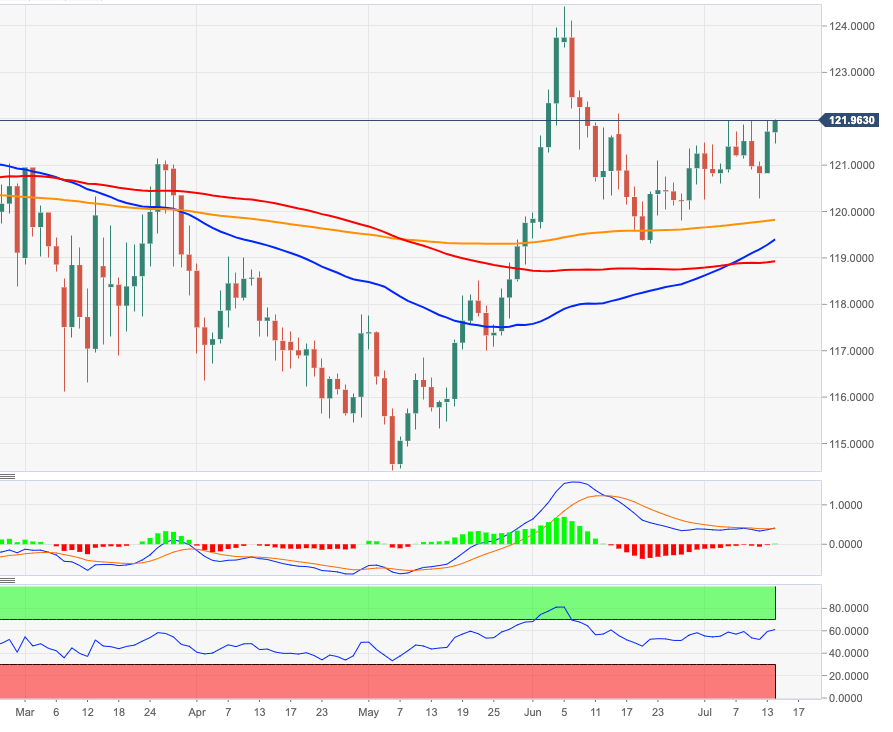

EUR/JPY Price Analysis: Next on the upside comes 122.87

- EUR/JPY is prolonging the bounce off recent lows and flirts with 122.00.

- Further up emerges the January 2020 peaks in the 122.85/90 band.

EUR/JPY is adding to the positive start of the week and it is already trading pips away from the key initial barrier in the 122.00 neighbourhood.

If the buying interest picks up pace and manages to clear this region, then the focus of attention should shift to the January’s top at 122.87 ahead of the 2020 peaks beyond the 124.00 mark.

As long as the 200-day SMA near 119.75 holds the downside, the outlook on the cross is seen as constructive. This contention area is also reinforced by June’s lows in the 119.30 region.

EUR/JPY daily chart