EUR/USD flirts with daily highs near 1.1360 post-ZEW

- EUR/USD gathers traction and tests tops near 1.1360/65.

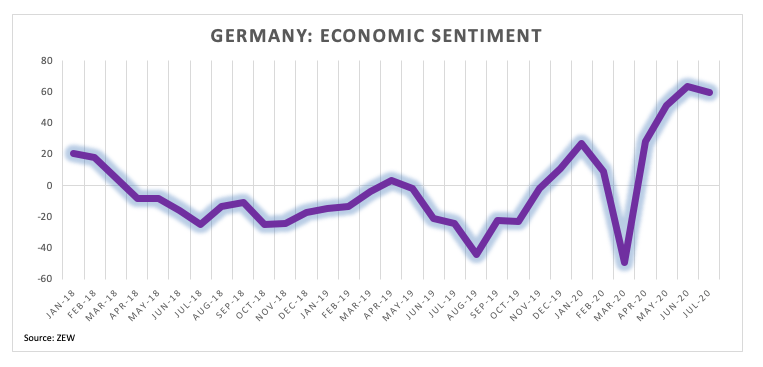

- German Economic Sentiment eased a tad to 59.3 in July.

- US CPI next of relevance in the US calendar on Tuesday.

The shared currency has left behind the initial pessimism and is now lifting EUR/USD to the area of daily peaks in the 1.1360/65 band on turnaround Tuesday.

EUR/USD bid after data, weak dollar

EUR/USD is up for the third session in a row on Tuesday, extending the breakout of 1.13 the figure and targeting the area of recent weekly tops around 1.1380.

The price action in the pair remains sustained by the persistent bearish note surrounding the greenback and against the backdrop of unremitting hopes of a strong recovery in both the euro area and the US, in spite of the relentless advance of the COVID-19 pandemic.

In the docket, the German Economic Sentiment tracked by ZEW came in a tad below estimates at 59.3 for the current month, while Industrial Production in the broader Euroland expanded strongly at a monthly 12.4% during May.

In the NA session, inflation figures gauged by the CPI will take centre stage seconded by the NFIB index and speeches by FOMC’s Brainard and Bullard.

What to look for around EUR

EUR/USD as started the week on the positive side once again, always supported by the solid improvement in the risk-associated universe and advancing to the 1.1380 region. The constructive view in the euro, in the meantime, stays well and sound and supported by the improvement of key fundamentals in the region amidst the current (and massive) monetary stimulus delivered by central banks. On top, the solid performance of the region’s current account is also adding to the attractiveness of the shared currency.

EUR/USD levels to watch

At the moment, the pair is gaining 0.11% at 1.1356 and a breakout of 1.1375 (monthly high Jul.13) would target 1.1422 (monthly high Jun.10) en route to 1.1495 (2020 high Mar.9). On the other hand, immediate contention is located at 1.1168 (monthly low Jun.19) seconded by 1.1147 (high Mar.27) and finally 1.1050 (200-day SMA).