Our best spreads and conditions

About platform

About platform

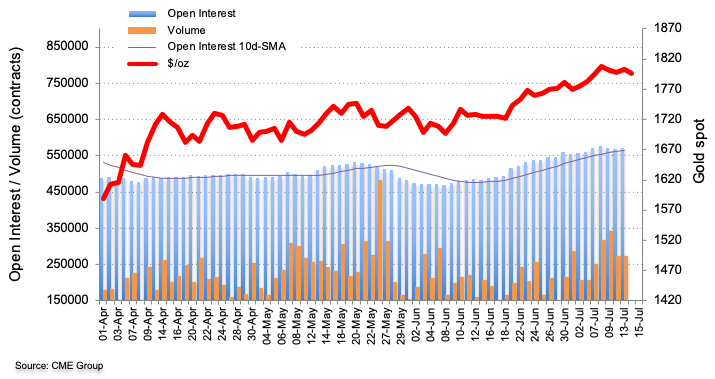

Open interest in Gold futures markets rose by almost 3.6K contracts on Monday, reversing two consecutive daily pullbacks, according to flash data from CME Group. Volume, in the same line, rose by just 80 contracts, marginally offsetting the previous drop.

Prices of the ounce troy of the precious metal managed to start the week with a firm note although closing the session below the $1,800 mark amidst rising open interest and volume. That said, some consolidation looks likely in the near-term in Gold, while extra gains are seen on a surpass of the recent 9-year highs near $1,820 per ounce