Our best spreads and conditions

About platform

About platform

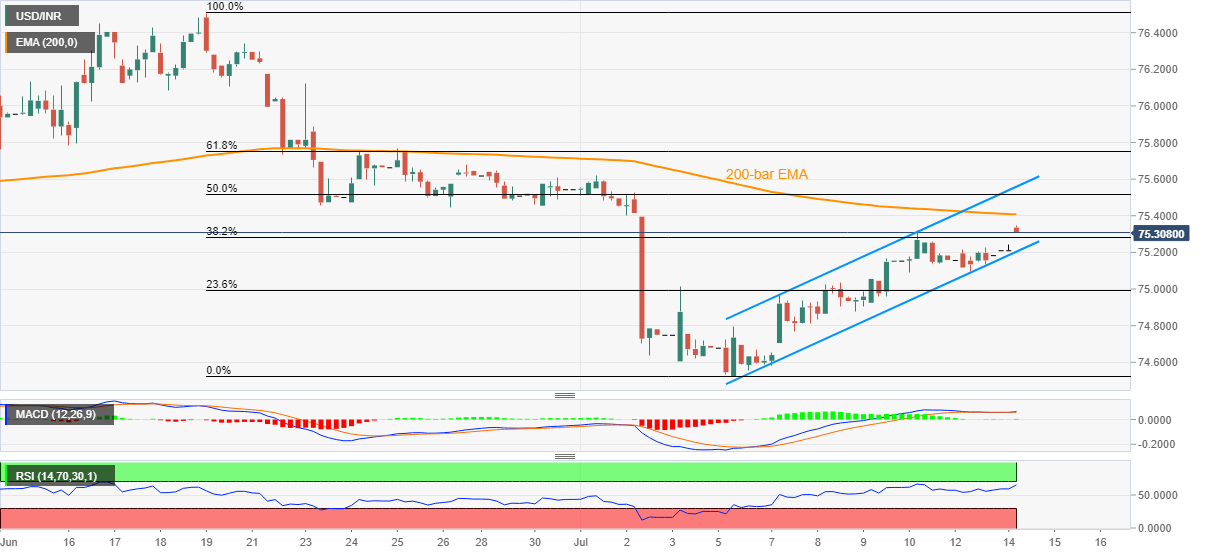

USD/INR eases from the intraday top to 75.30 while heading into the European session on Tuesday. In doing so, the quote reverses before the key 200-bar EMA, amid overbought RSI, despite staying inside a week-long rising channel formation.

While RSI and MACD suggest further pullback, the support line of the said channel, at 75.20 now, will stop the bears targeting 75.00 threshold.

If the quote remains weak past-75.00, which is less expected, the monthly bottom around 74.50 might not be able to satisfy the pessimists.

On the flip side, a 200-bar EMA level of 75.41 will keep challenging the short-term buyers ahead of 50% Fibonacci retracement level of the pairs drop from June 19 to July 06, around 75.52.

However, the quote’s further upside past-75.52 will have to defy the channel’s resistance line, around 75.60, to aim for a 61.8% Fibonacci retracement level of 75.75.

Trend: Further recovery expected