China-India border tensions spark trade friction in 5G and autos – Nikkei

The Nikkei's Asian Review has reported on the border crisis between China and India.

The article states that the crisis has begun to spill over into bilateral trade as the Indian government considers imposing restrictions and higher tariffs on Chinese companies and goods.

Lead paragraphs

Measures include a directive against the use of telecommunications equipment from Huawei Technologies and other Chinese suppliers. China's auto sector is also being targeted.

After the first deadly clash between the two Asian giants in 45 years, India's Prime Minister Narendra Modi can ill afford to look weak in front of China. But shutting out Chinese investment risks hurting India's already weak economy.

Market implications

These developments are pertaining to a standoff in the Himalayan border region that began in early May between Indian and Chinese troops. A pushback in trade and investment will weigh on an already suffering Indian economy, especially in the manufacturing sectors which cannot operate without access to Chinese-made products and likely stem flow into the nation's currency.

The Indian economy is at the brink of crisis stemming from the coronavirus pandemic. The International Monetary Fund (IMF) has recently downgraded forecasts for India's economic growth for 2020 to negative 4.5%, marking the possibility of the worst slump since the oil crisis of the late 1970s.

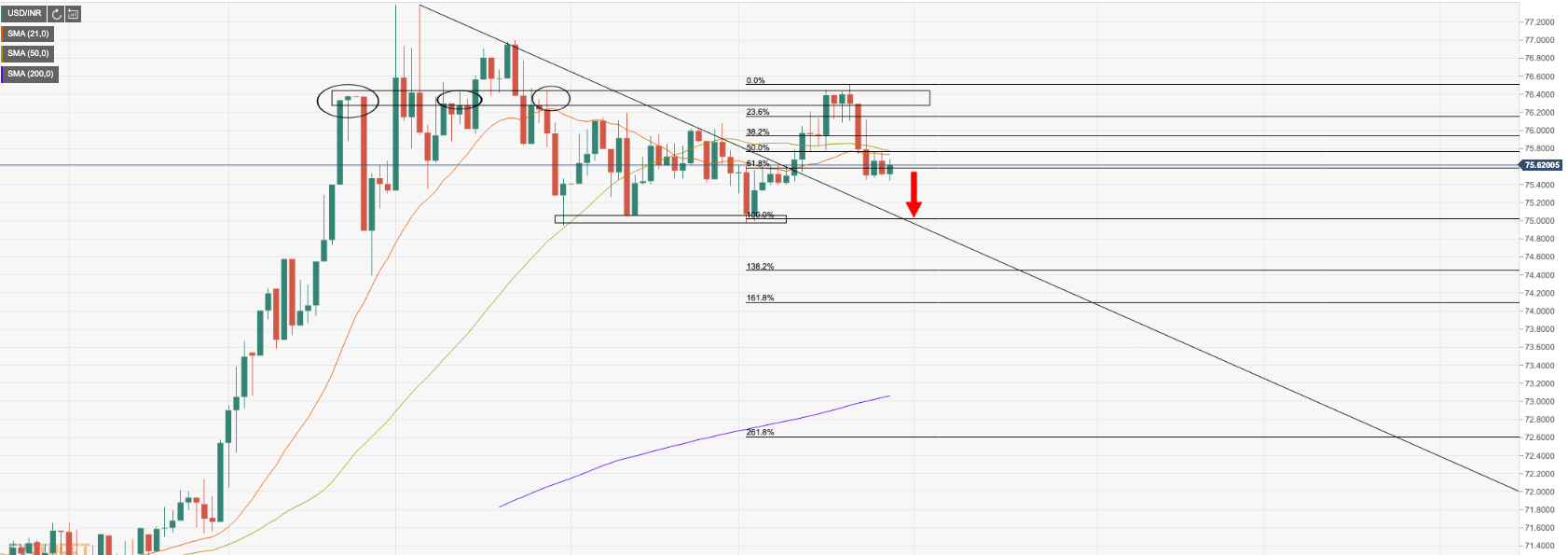

USD/INR at critical support and bears look to prior structure

A continuation below the 61.8% Fibonacci and break of support opens risk to a full retracement of the daily impulse and a test of the trendline.