Back

27 May 2020

Natural Gas Price: Cautiously positive

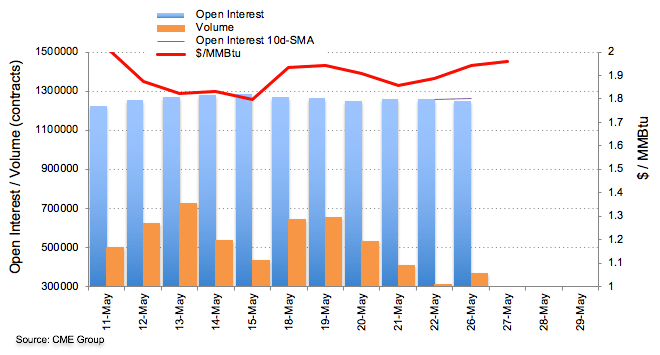

CME Group’s preliminary data for Natural Gas futures markets noted open interest shrunk for the second session in a row on Tuesday, this time by nearly 7.5K contracts. On the other hand, volume increased by nearly 60K contracts, reversing at the same time three daily pullbacks.

Natural Gas Prices Forecast

Prices of the MMBtu of the commodity are up for the second consecutive session on Wednesday. Decreasing open interest hints at the likeliness that further upside could be losing momentum as the key resistance at $2.00 looms closer.

Prices of Natural Gas have left behind the 55-day and 100-day SMAs and are now targeting the key barrier at $2.00 per MMBtu. Above recent peaks in the $2.02 area the move up could re-visit April’s top around $2.10 per MMBtu.