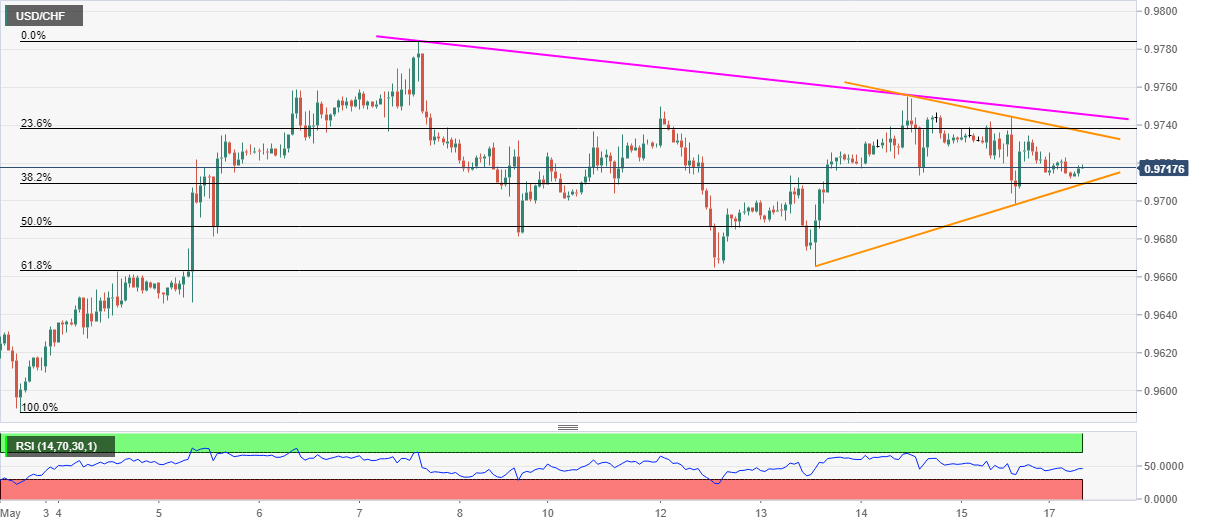

USD/CHF Price Analysis: Consolidates above 0.9700 inside short-term triangle

- USD/CHF recovers from intraday low but stays inside the immediate symmetrical triangle.

- A seven-day-old falling trend line adds to the resistance ahead of the monthly top.

- 61.8% Fibonacci retracement restricts the short-term downside.

Following its U-turn from the daily low of 0.9712, USD/CHF registers modest gains of 0.05% while trading around 0.9718 during the early Monday.

Even so, the quote stays inside a short-term symmetrical triangle established connecting lows from May 13 and highs since May 14, 2020.

Hence, the pair’s latest pullback might aim for the formation’s resistance, at 0.9735 now, whereas another falling trend line from May 07, currently near 0.9750, can question the bulls afterward.

Given the pairs’ ability to cross 0.9750, a monthly top near 0.9785 can be challenged during the further upside.

On the downside, a confluence of the pattern’s support line and 38.2% Fibonacci retracement level of the early-month upside, around 0.9710, restricts the pair’s immediate declines.

Also acting as the strong support could be 61.8% Fibonacci retracement level around 0.9665.

USD/CHF hourly chart

Trend: Sideways