Back

6 May 2020

USD/INR New York Price Forecast: Greenback parked below 76.00 figure vs. Indian rupee

- USD/INR bull trend remains intact on the third day of the week.

- The level to beat for bulls is the 76.00 resistance.

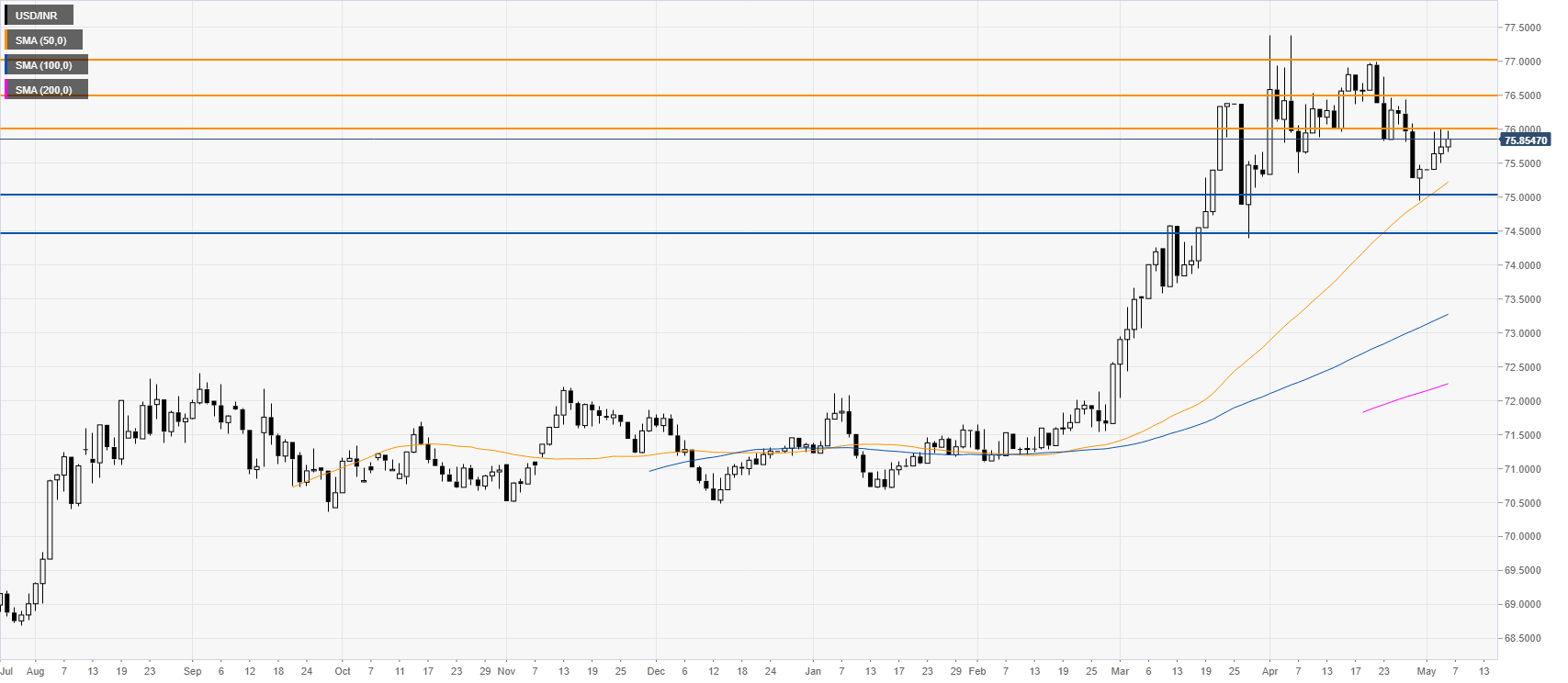

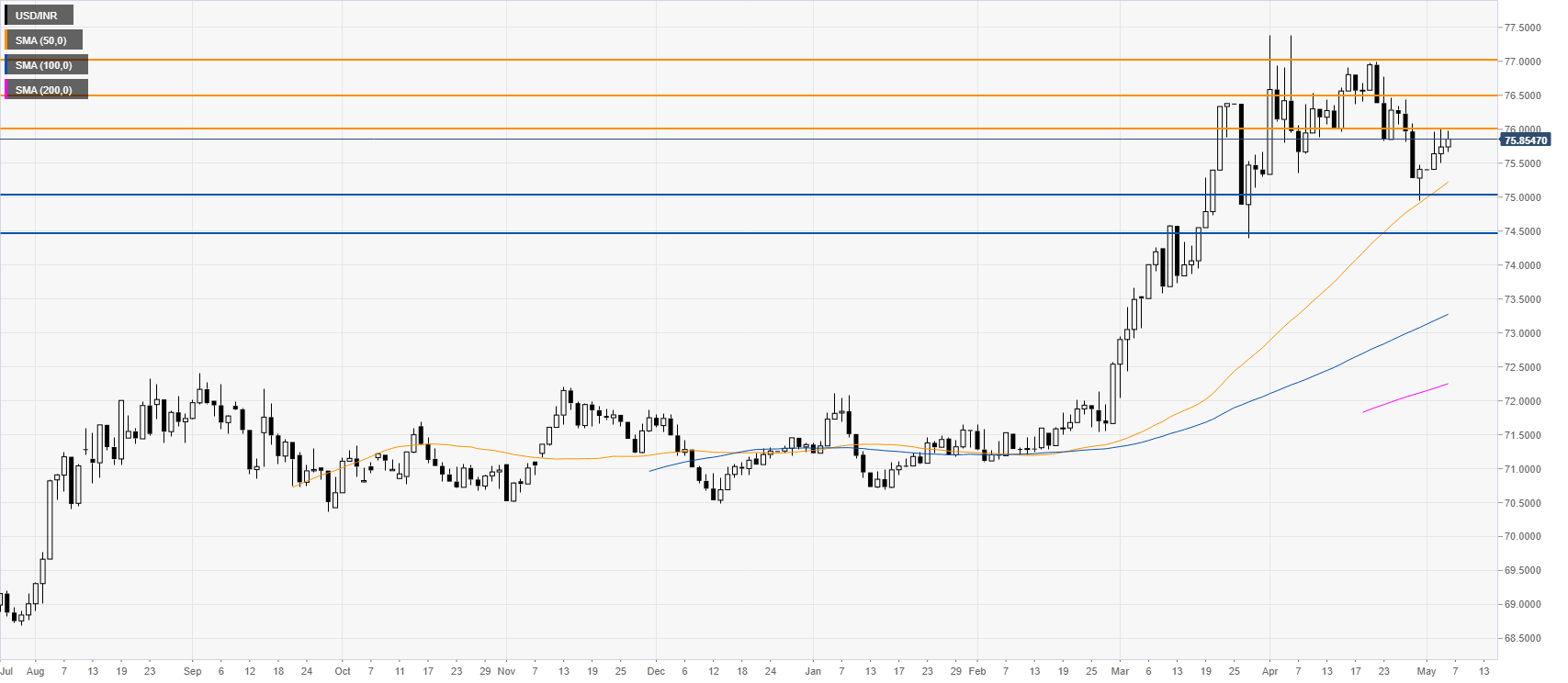

USD/INR daily chart

USD/INR uptrend remains intact as the spot is trading above the main SMAs. The quote is rebounding while challenging the 76.00 figure. As buyers remain in control a break beyond the mentioned level can open the gates to further gains towards the 76.50 and 77.00 levels in the medium-term. On the flip side, support can be seen near the 75.00 and 74.50 price levels.

Additional key levels