Back

4 May 2020

Crude Oil Futures: Further upside looks limited

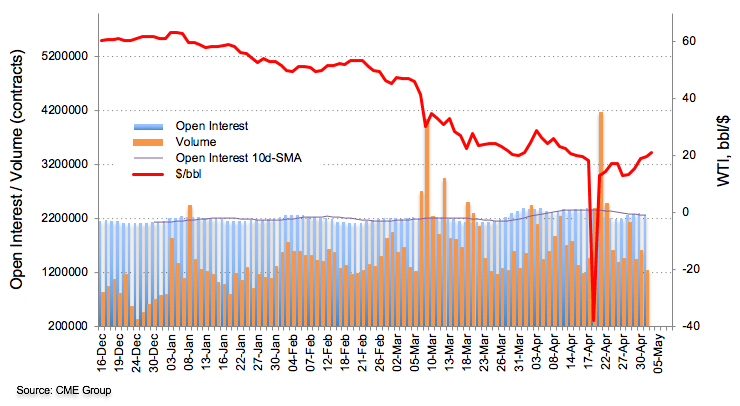

CME Group’s advanced data for Crude Oil futures markets saw open interests shrinking by around 45.7K contracts at the end of last week following four consecutive builds. In the same line, volume went down by around 367.4K contracts, prolonging the erratic performance seen as of late.

WTI eyes a move to $29.00/bbl

Prices of the barrel of WTI kept the recovery well and sound on Friday, closing in levels just shy of the key $20.00 mark. That said, while a move to April’s highs above the $29.00 mark per barrel remains on the cards in the short-term horizon, shrinking open intertest and volume leaves further upside somewhat limited.