Back

28 Apr 2020

US Dollar Index Asia Price Forecast: DXY losing steam, slips below 100.00 mark

- US dollar index (DXY) is on track to end the New York session below the 100.00 psychological level.

- It is unclear if the bull can lift the market above the 100.00 mark in the medium-term.

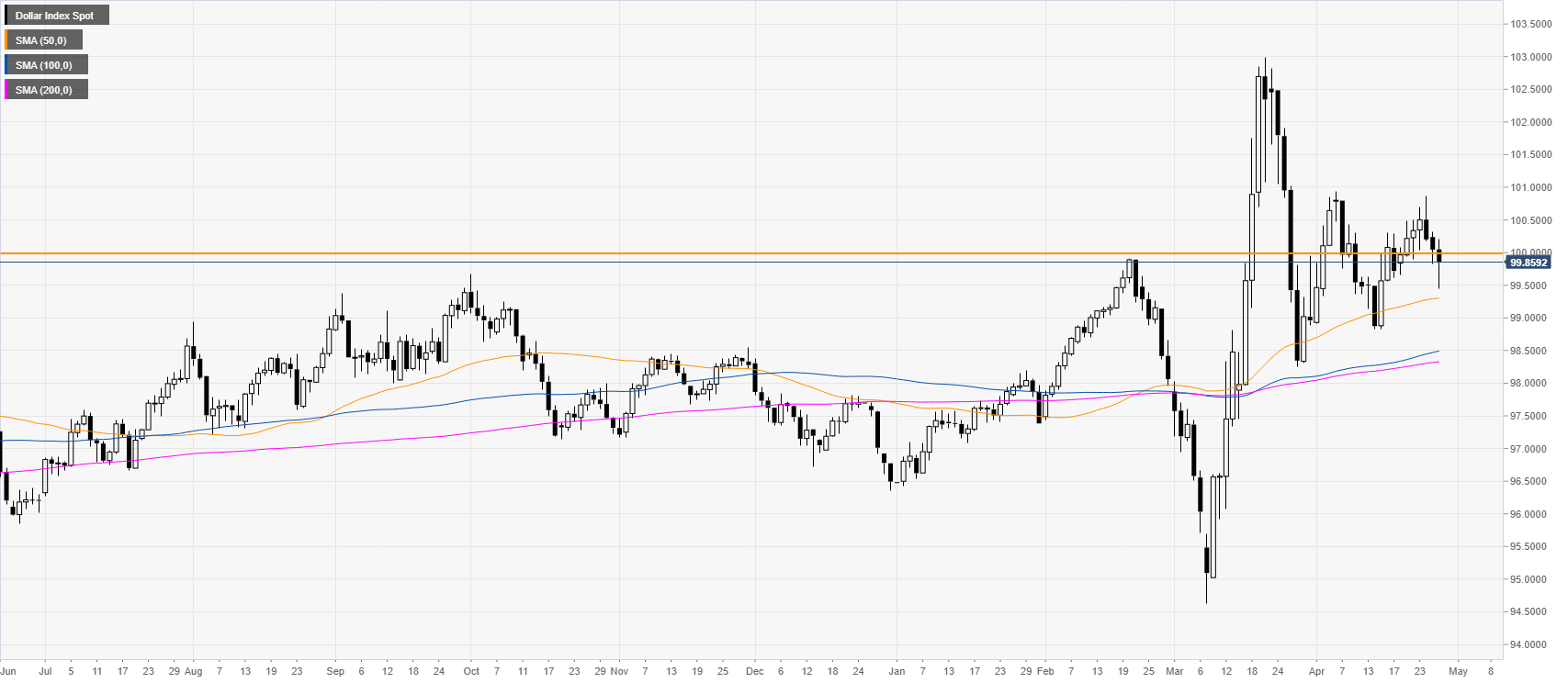

DXY daily chart

DXY is trading above the daily SMAs suggesting an overall bullish bias, however, the greenback slipped below the 100.00 mark important psychological level.

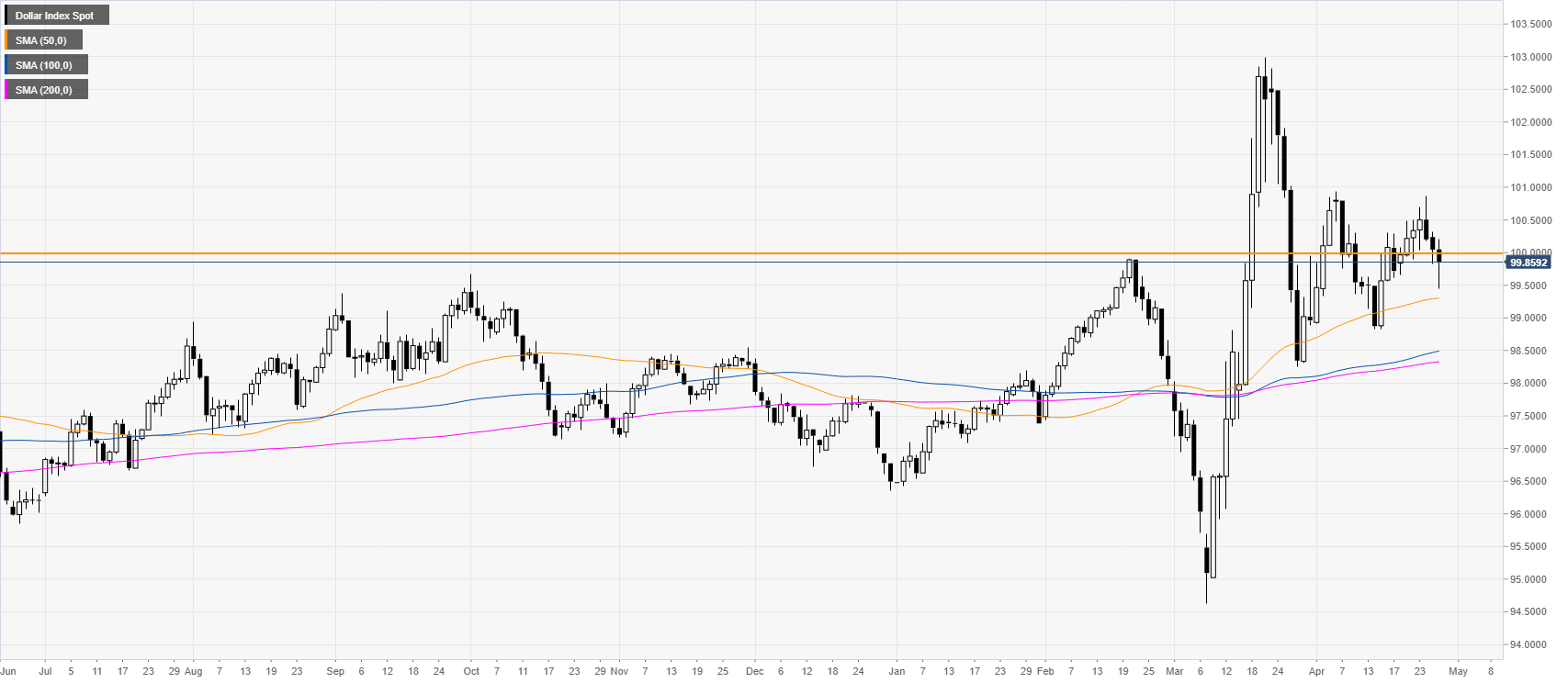

DXY four-hour chart

DXY had a reaction up in the New York session but fell below the 100.00 level and the main SMAs, therefore, it remains to be seen if the buyers in the medium-term can return back to the market or if the index will continue sliding towards 99.30 and 98.90 levels. On the flip side, resistance can be seen near 100.00 and 100.50 levels.

Additional key levels