Back

28 Apr 2020

EUR/USD Price Analysis: Euro trims intraday gains, trades near 1.0840 level

- Bullish intraday attempt loses steam below the 1.0900 figure.

- The level to beat for sellers remains the 1.0800 support.

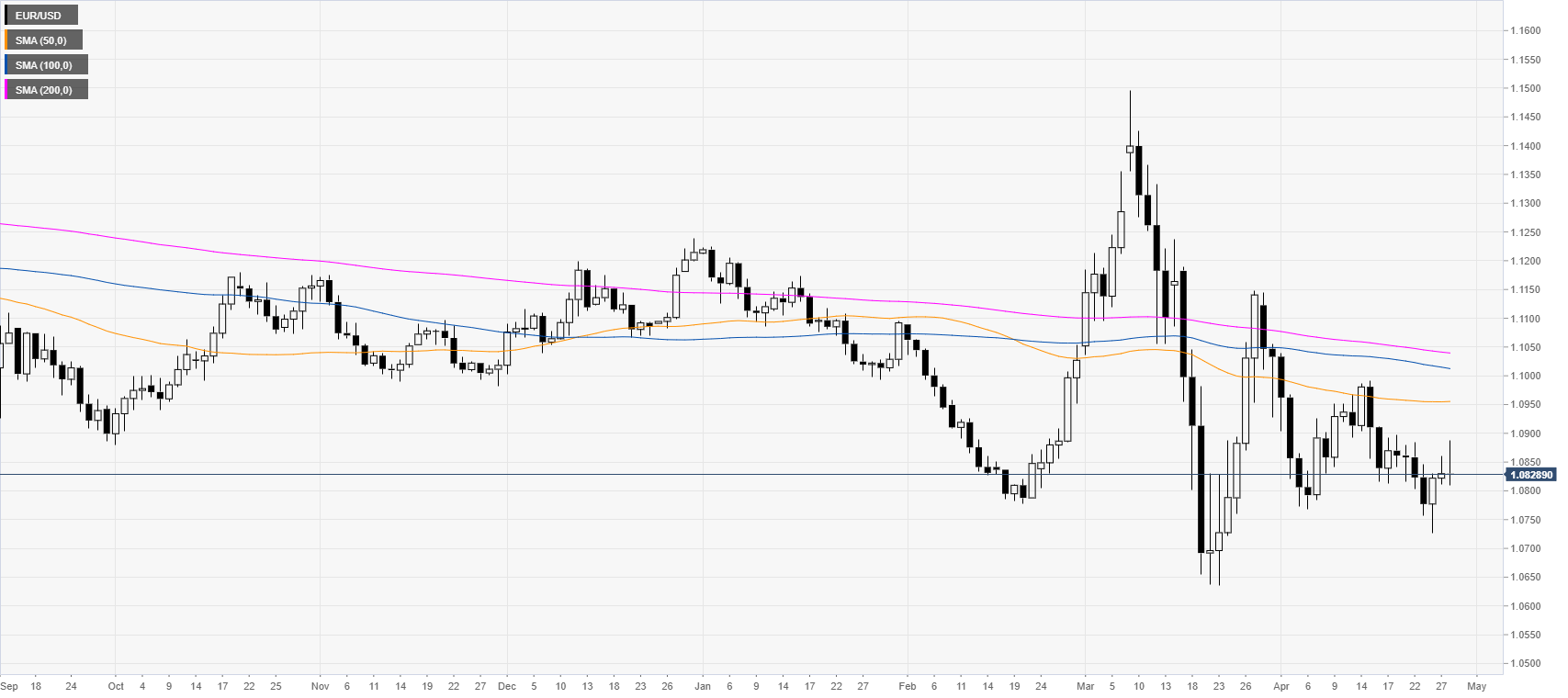

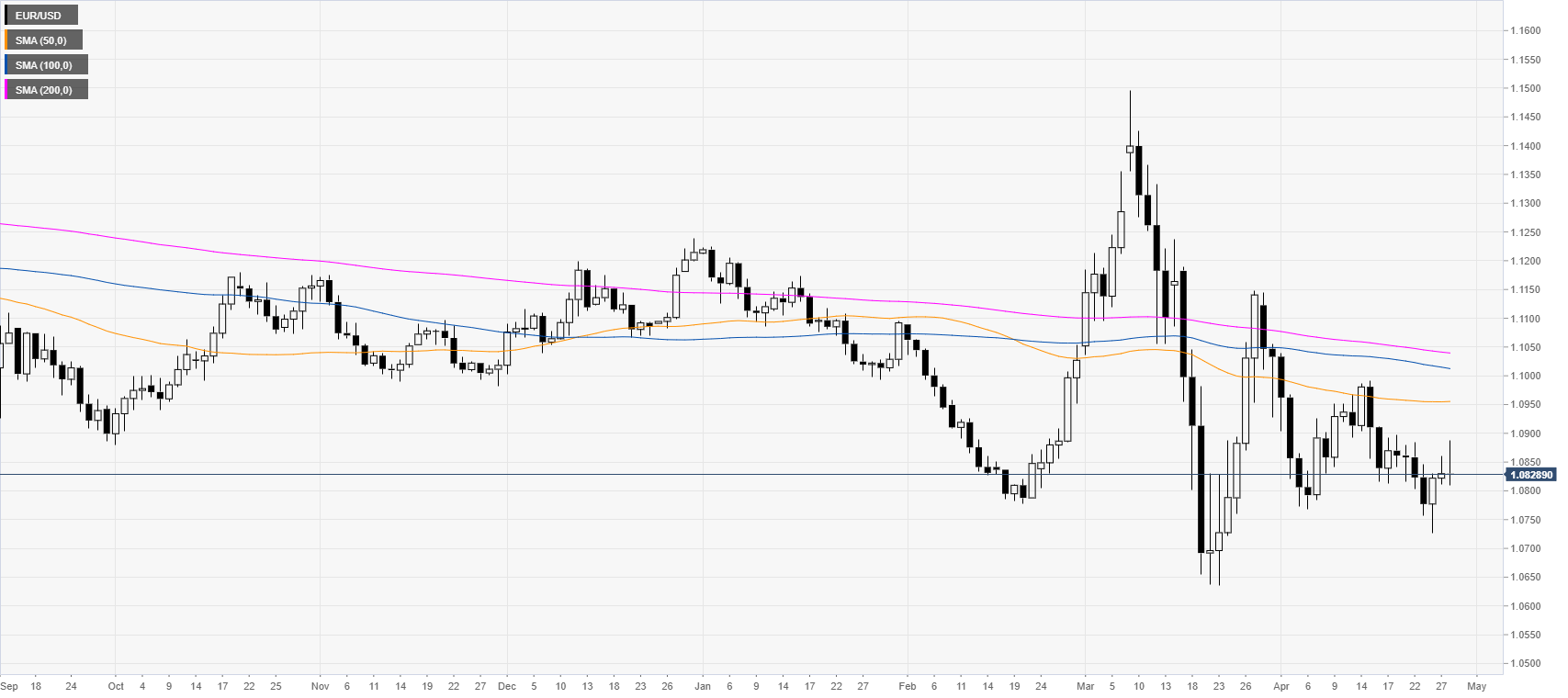

EUR/USD daily chart

Euro/Dollar is trading within familiar while erasing intraday gains as the spot is trading below the main daily SMAs suggesting an overall bearish bias.

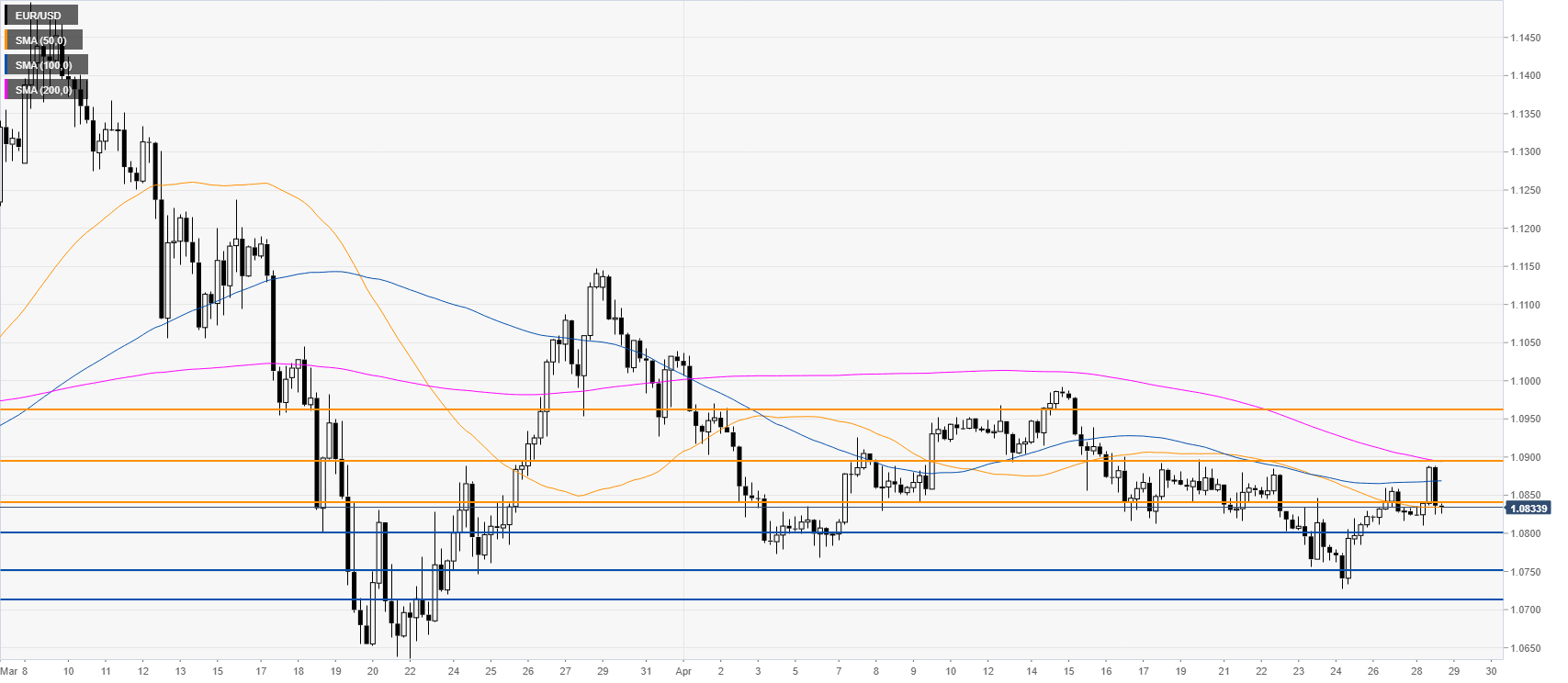

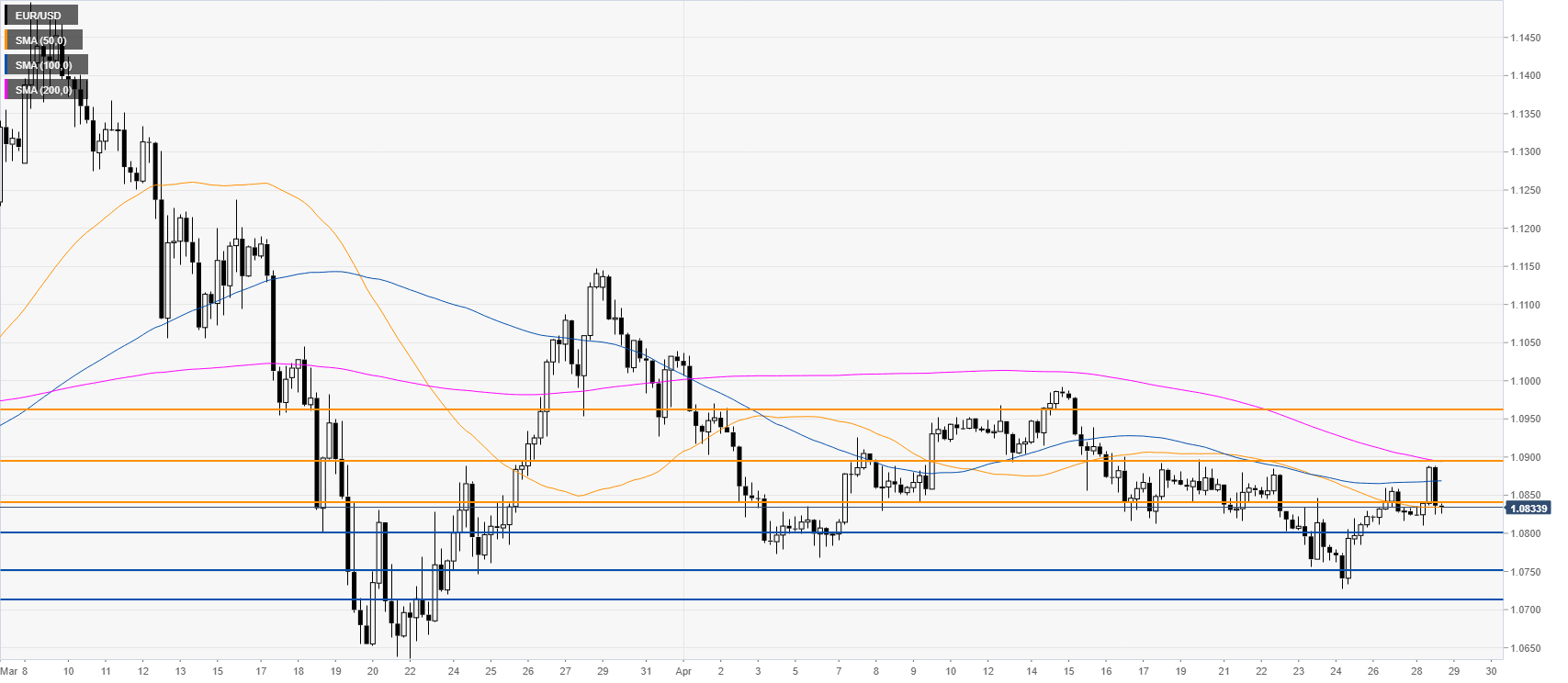

EUR/USD four-hour chart

EUR/USD rejected the 1.0900 resistance and the 100/200 SMAs on the four-hour chart suggesting that the bears are remaining in control. However, a daily close below the 1.0800 figure would embolden the bear case and open the door to further losses towards the 1.0750 and 1.0714 levels. Conversely, resistance is expected to emerge near 1.0841, 1.0900 and 1.0965 levels, according to the Technical Confluences Indicator.

Resistance: 1.0841, 1.0900, 1.0965

Support: 1.0800, 1.0750, 1.0717

Additional key levels