Back

28 Apr 2020

Silver New York Price Forecast: XAG/USD sidelined above $15.00/oz, bullish

- XAG/USD recovery from the 2020 lows remains intact.

- The level to beat for buyers is the 15.43 level.

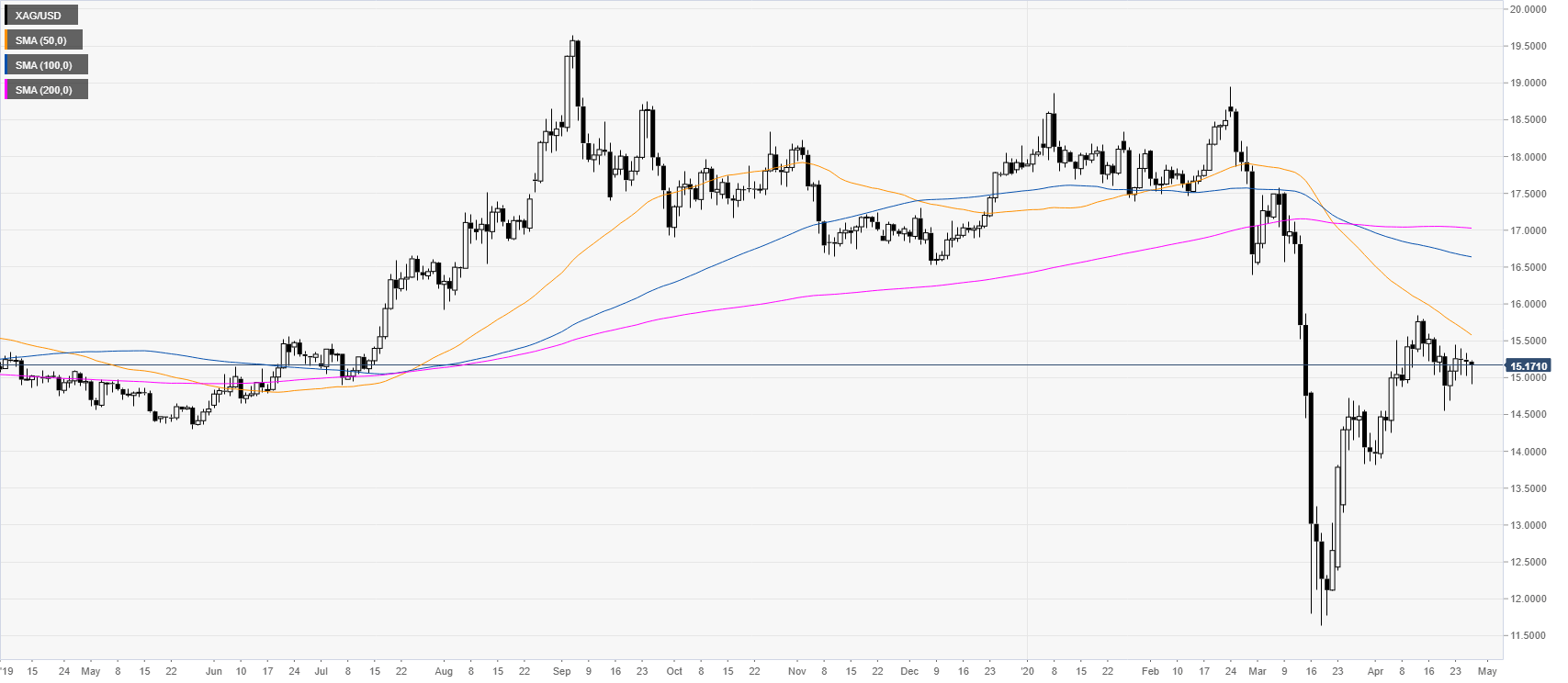

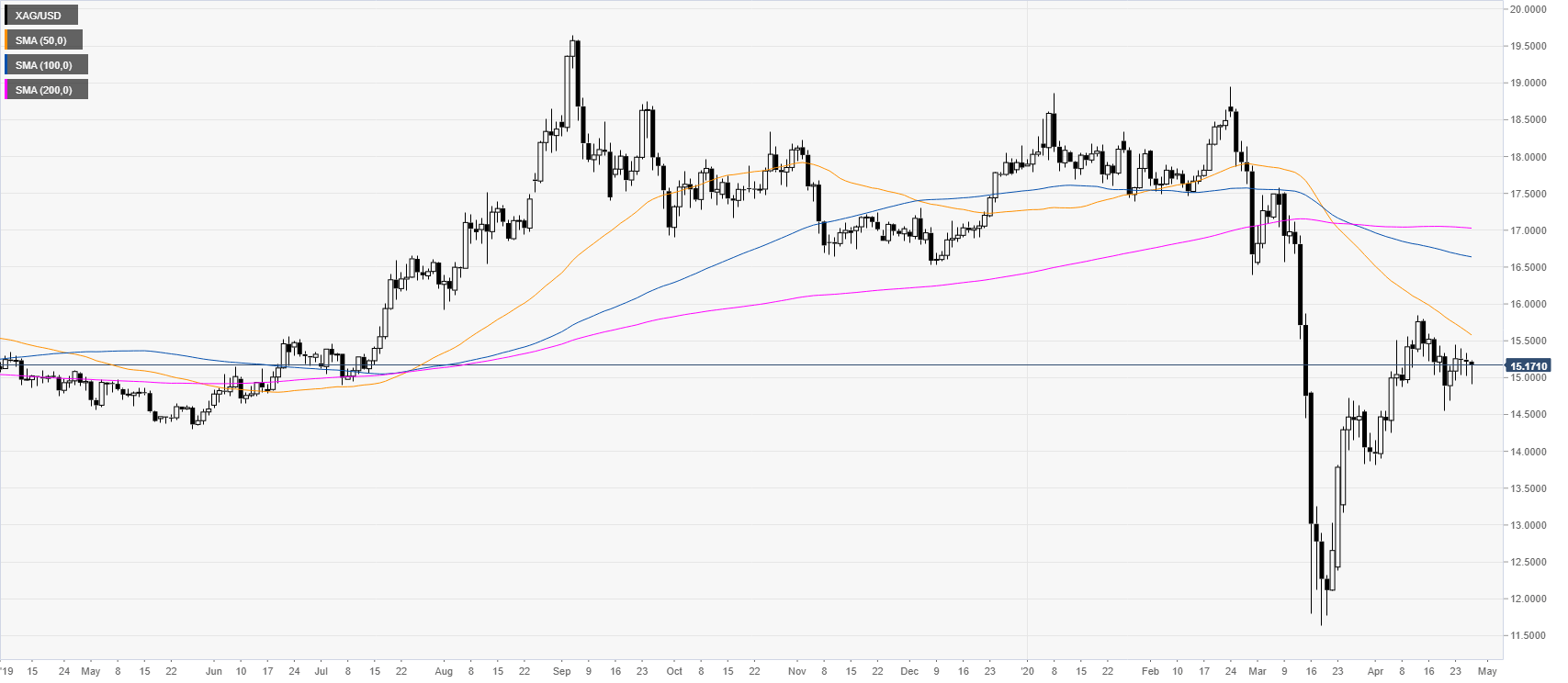

Silver daily chart

XAG/USD is consolidating the massive bullish correction from mid-March. However, the white metal stays below its main SMAs on the daily chart suggesting a bearish bias in the long run but stays bullish in the medium-term.

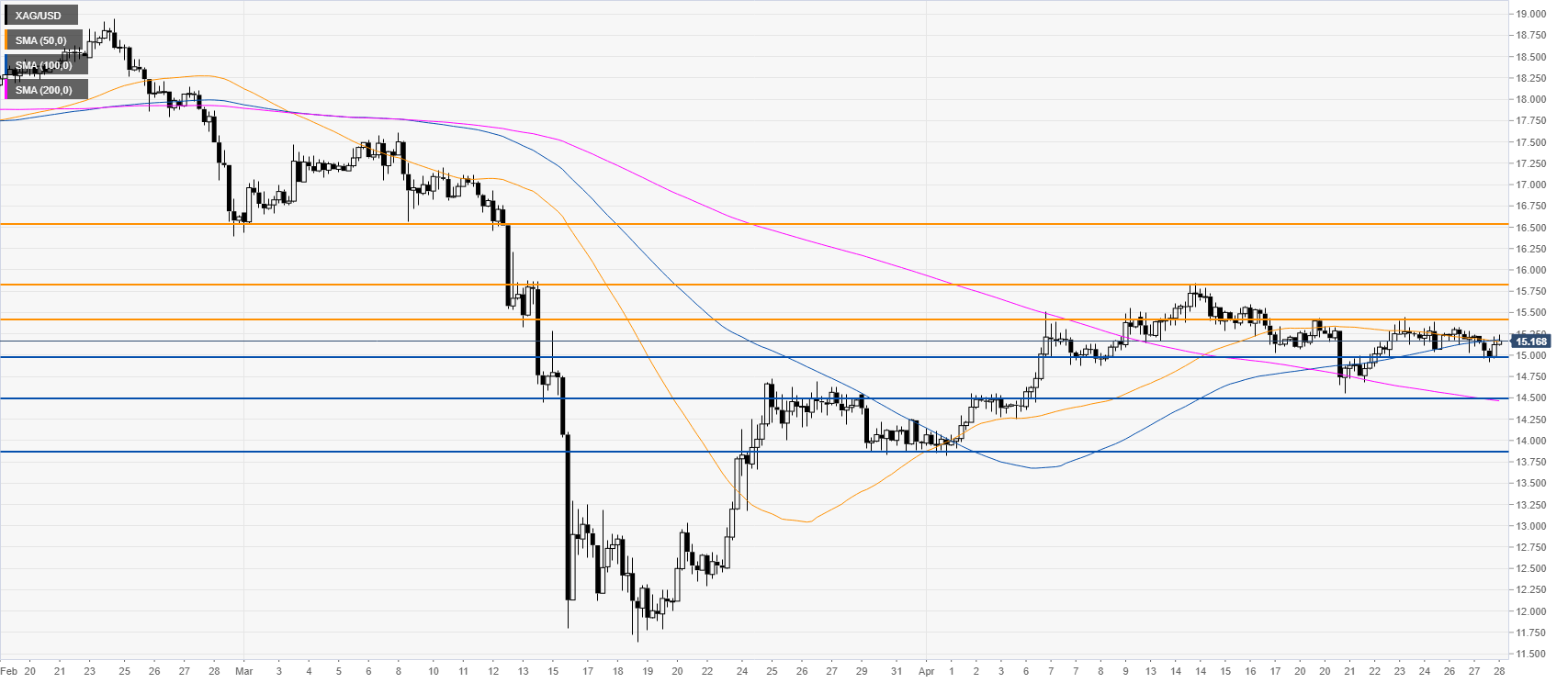

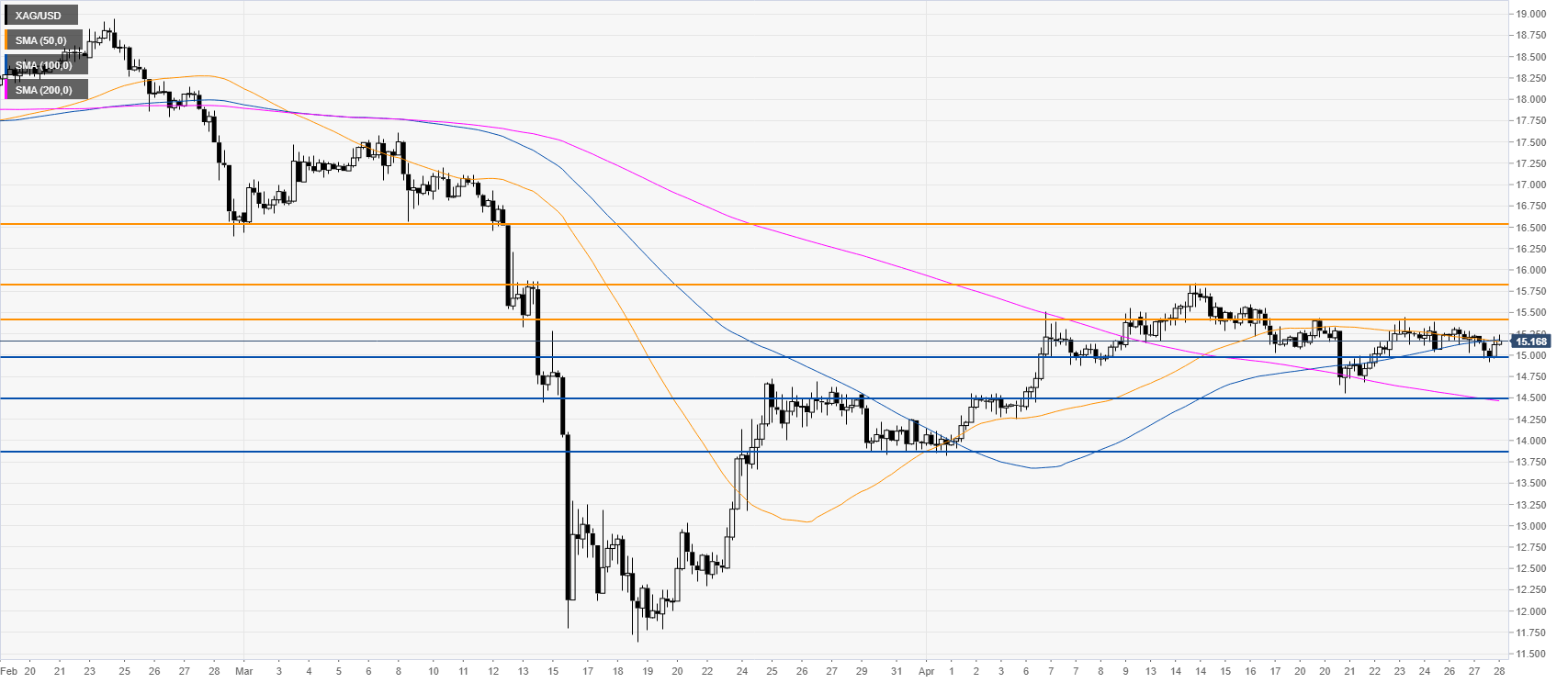

Silver four-hour chart

XAG/USD is trapped in a tight range above $15.00/oz near the 50 and 100 SMAs while above the 200 SMA. The correction stays intact as bulls will be looking for a break above the 15.43 resistance en route towards the 15.85 and 16.50 levels on the way up. Conversely, occasional dips should meet support near 15.00 and 14.50 price levels.

Resistance: 15.43, 15.85, 16.50

Support: 15.00, 14.50, 13.90

Additional key levels