USD/CAD Price Analysis: Slides to fresh 2-week lows, below mid-1.3900s

- USD/CAD witnessed some aggressive selling on Tuesday and tumbled to near two-week lows.

- A broad-based USD weakness, a modest recovery in oil prices exerted some heavy pressure.

- The set-up still seems tilted in favour of bears and supports prospects for a further decline.

The USD/CAD pair failed to capitalize on its attempted recovery move, instead met with some aggressive supply and tumbled to near two-week lows on Tuesday.

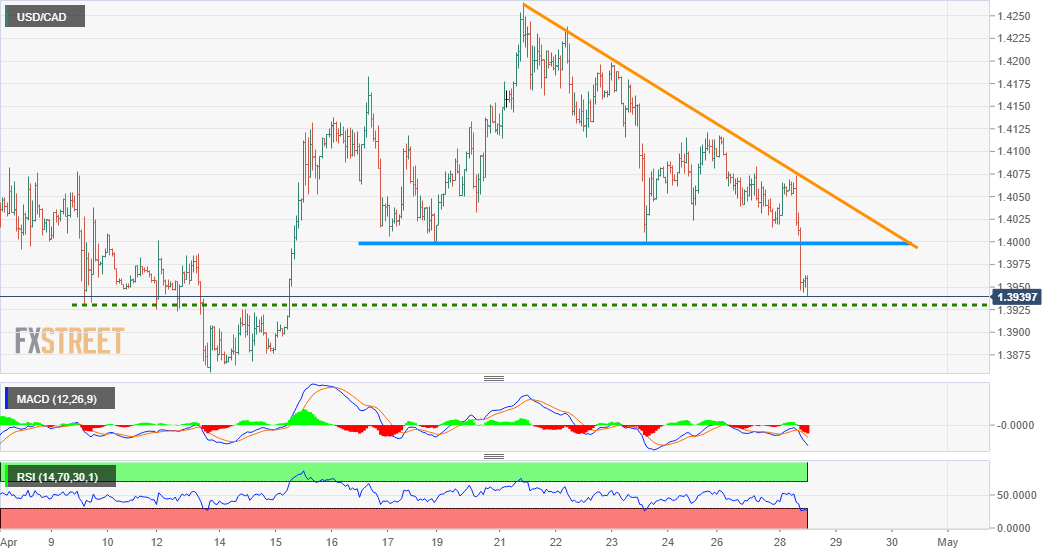

The steep intraday decline, marking the fourth day of a negative move in the previous five, took along trading stops near the key 1.40 psychological mark.

The mentioned level marked an important horizontal support, which constituted towards the formation of a bearish descending triangle on short-term charts.

The pair has now found acceptance below the triangle support and hence, seems vulnerable to extend the depreciating move amid a broad-based USD weakness.

This coupled with a goodish intraday bounce in oil prices underpinned the commodity-linked currency – the loonie – and adds credence to the bearish outlook.

Bears might now aim towards testing the 1.3930-20 support area, which if broken might turn the pair vulnerable to slide further towards testing sub-1.3900 levels.

On the flip side, any attempted recovery now seems to confront some fresh supply and remain capped near the mentioned support breakpoint, around the 1.40 mark.

That said, some follow-through buying might prompt some short-covering move and lift the pair back towards the descending trend-line, around the 1.4050-60 region.

USD/CAD 1-hourly chart

Technical levels to watch