Back

28 Apr 2020

Oil Price Analysis: WTI stays under pressure, approaching $10.00 a barrel

- WTI remains bearish despite the risk-on mood.

- The level to beat for sellers is the 9.87 support on the WTI futures June contract.

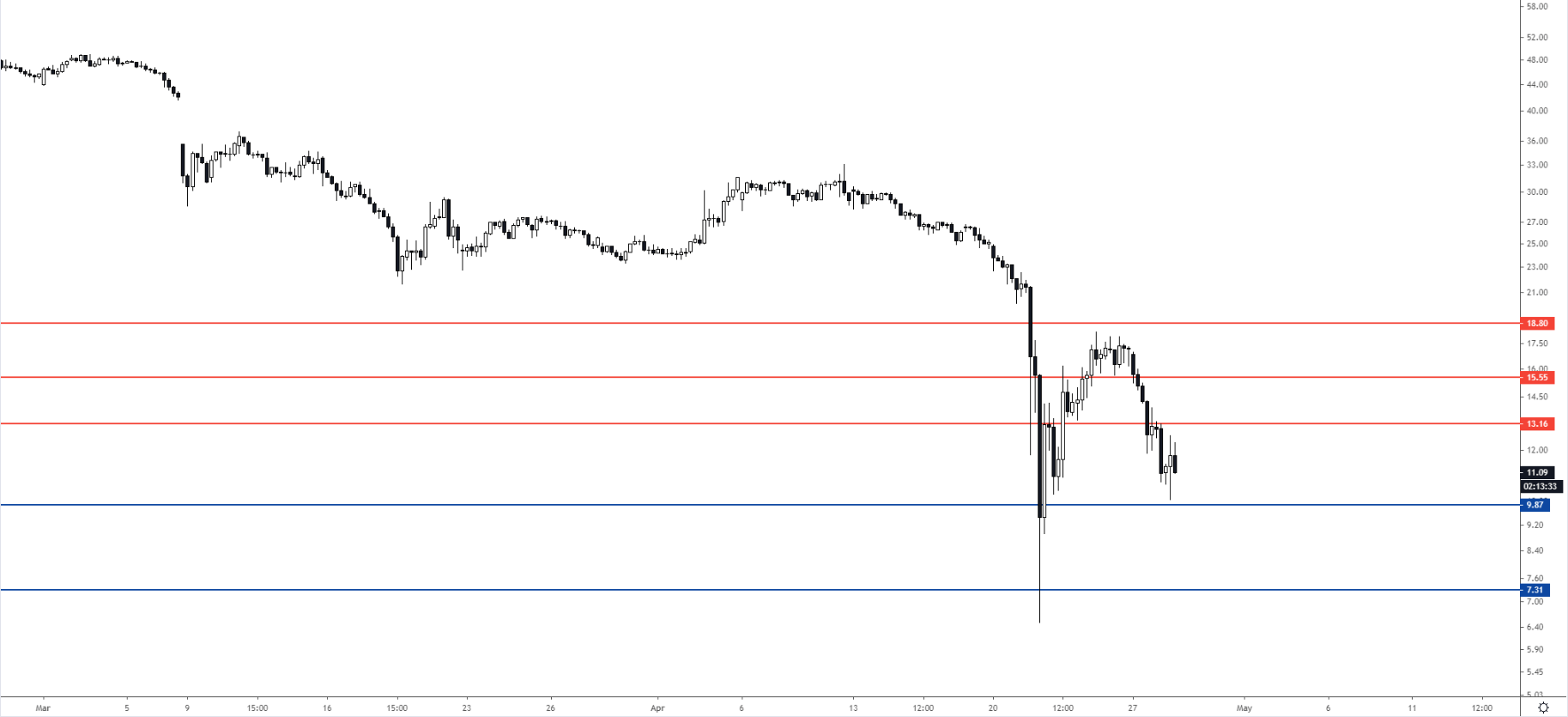

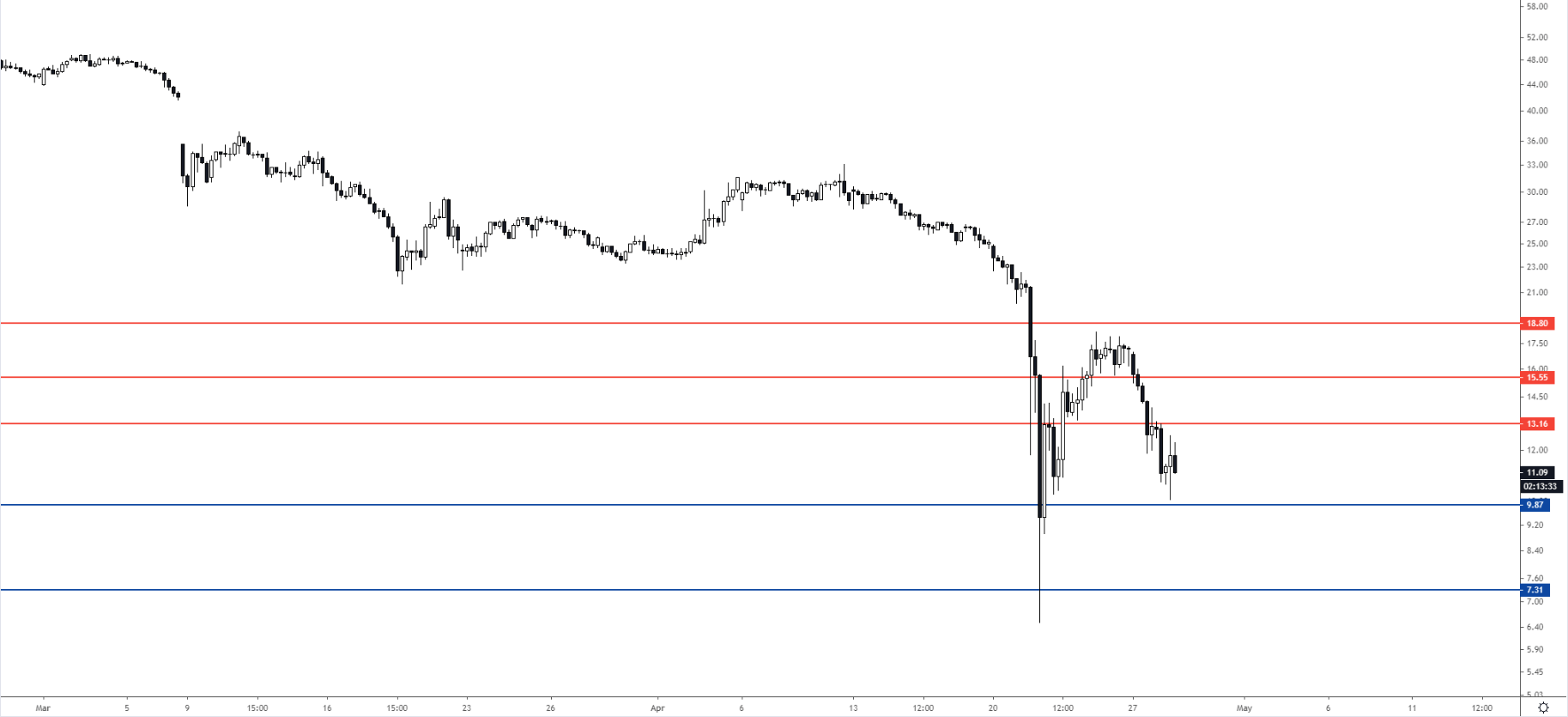

WTI four-hour chart

Despite the general risk-on mood, WTI remains very weak after the bounce from historic lows to 18.00 a barrel (WTI futures June contract). As sellers remain in full control, a break below 9.87 can yield further weakness towards the 7.31 support level in the medium term. Bullish attempts are likely to be short-lived with resistances likely to emerge near 13.16, 15.55 and 18.80 levels.

Additional key levels