Back

25 Mar 2020

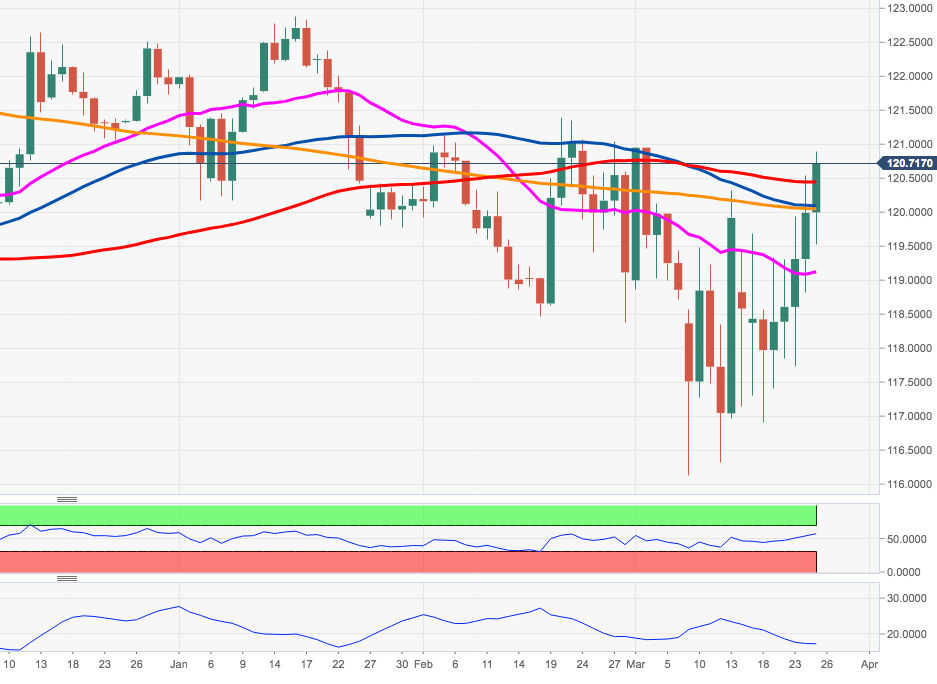

EUR/JPY Price Analysis: Recovery now targets the 121.50 region

- EUR/JPY keeps the recovery alive and is approaching the 121.00 zone.

- Immediately to the upside emerges the February’s top near 121.50.

EUR/JPY keeps the bullish mood well in place for yet another session on Wednesday.

The cross has broken above the critical 200-day SMA in the 120.00 neighbourhood and in doing so it has opened the door for a potential move to the February’s peak near 121.50.

As long as the 200-day SMA, today at 120.02, holds the downside, there is still scope for the continuation of the rally.

EUR/JPY daily chart