Our best spreads and conditions

About platform

About platform

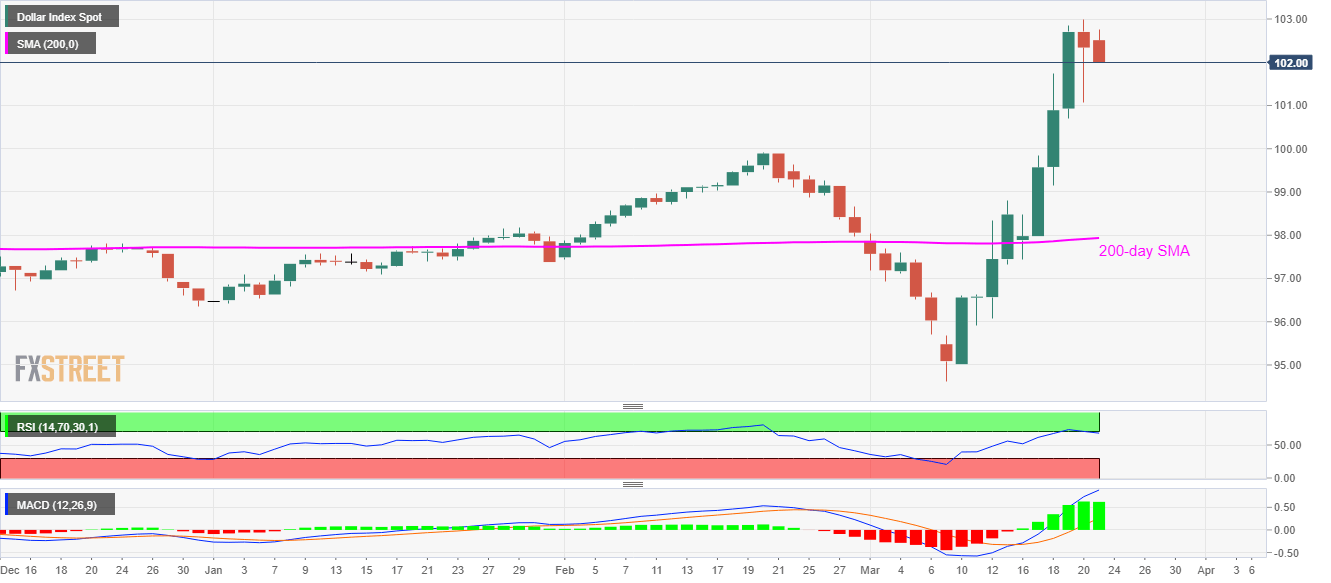

While extending its pullback from 103.00, flashed on Friday, the US dollar Index (DXY) drops to 102.06, down 0.28% while heading into the European open on Monday.

Other than the greenback gauge’s failure to stay strong beyond the 38-month top, overbought RSI conditions also favor the sellers.

As a result, April 2017 top near 99.90 can please the bears during the further downside whereas 200-day SMA around 97.94 could be on their radars afterward.

Alternatively, a sustained break beyond 103.00 will push the bulls towards challenging the year 2017 high close to 103.80.

Trend: Pullback expected