Back

23 Mar 2020

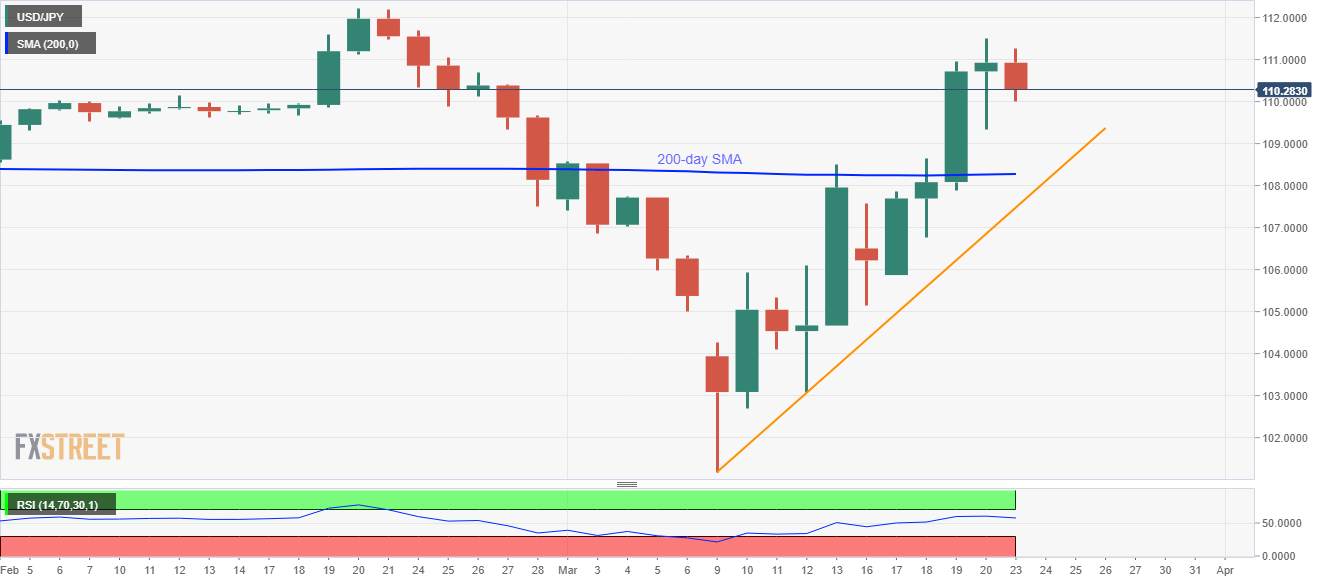

USD/JPY Price Analysis: 200-day SMA back in focus

- USD/JPY snaps four-day winning streak.

- 111.50 holds the key to February high.

- Repeated failures to dip below 110.00 signal intermediate pullback.

- The monthly support trend line follows the 200-day SMA.

Despite repeated failures to take out 110.00, USD/JPY registers 0.54% loss while declining to 110.32 during early Monday.

In doing so, the pair snaps the four-day winning streak while also highlighting 200-day SMA for the bears.

However, a sustained break below 110.00 becomes necessary for the sellers to aim for a 200-day SMA level of 108.28 whereas an upward sloping trend line since March 09, 2020, around 107.50, could question the bears afterward.

Meanwhile, buyers will take entry beyond the monthly top surrounding 111.50, a break of which could challenge February month high near 112.20/25.

USD/JPY daily chart

Trend: Pullback expected