Back

23 Mar 2020

EUR/USD Price Analysis: Bounces off multi-month low to regain 1.0720

- EUR/USD recovers from the three-year low.

- 50-HMA, three-day-old resistance line cap immediate upside.

- Sellers will wait for entry below 1.0630.

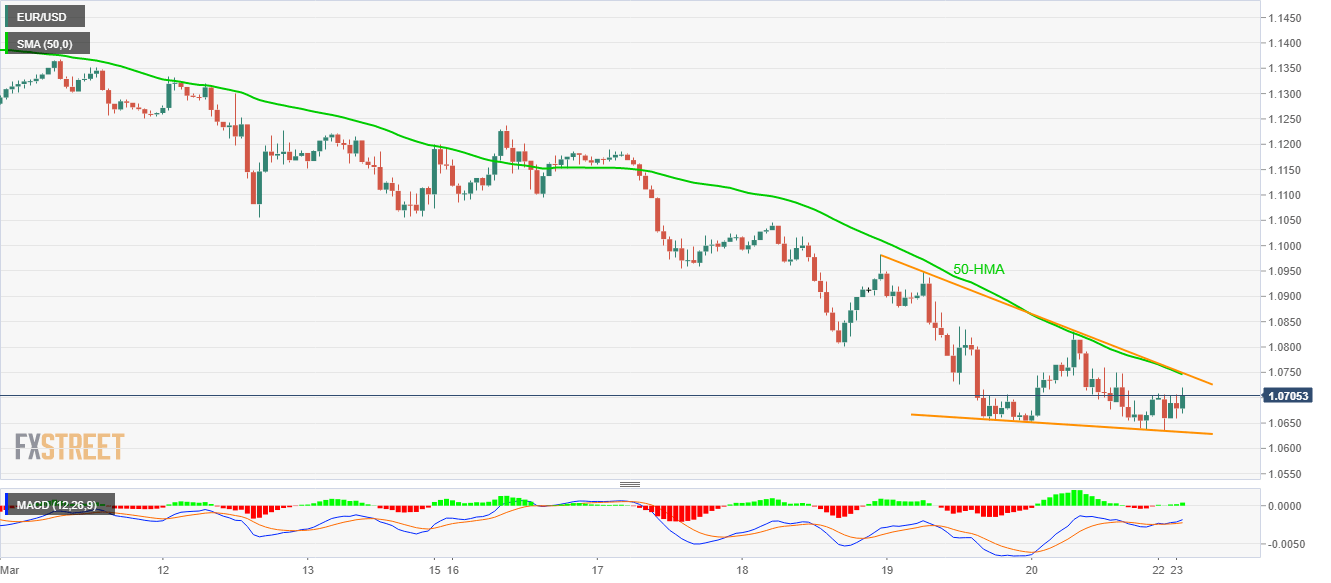

Following its initial drop to a 35-month low, EUR/USD marks 0.13% gains to 1.0711, with an intraday high of 1.0720, amid the early Monday.

While taking supports from bullish MACD, the pair heads to 50-HMA and a short-term falling trend line resistance, around 1.0750, a break of which could escalate the recovery moves to 1.0980.

In a case where buyers manage to dominate past-1.0980, the previous week’s top near 1.1240 could return to the charts.

On the contrary, the pair’s declines below the immediate descending trend line support, at 1.0630, holds the key to its further downside towards 1.0600 and February 2017 low near 1.0490.

EUR/USD hourly chart

Trend: Bearish