EUR/USD Price Analysis: Looks north after strong bounce from key Fib

- EUR/USD's repeated defense of key Fibonacci levels has revived the immediate bullish view.

- The pair could challenge the psychological hurdle of 1.12.

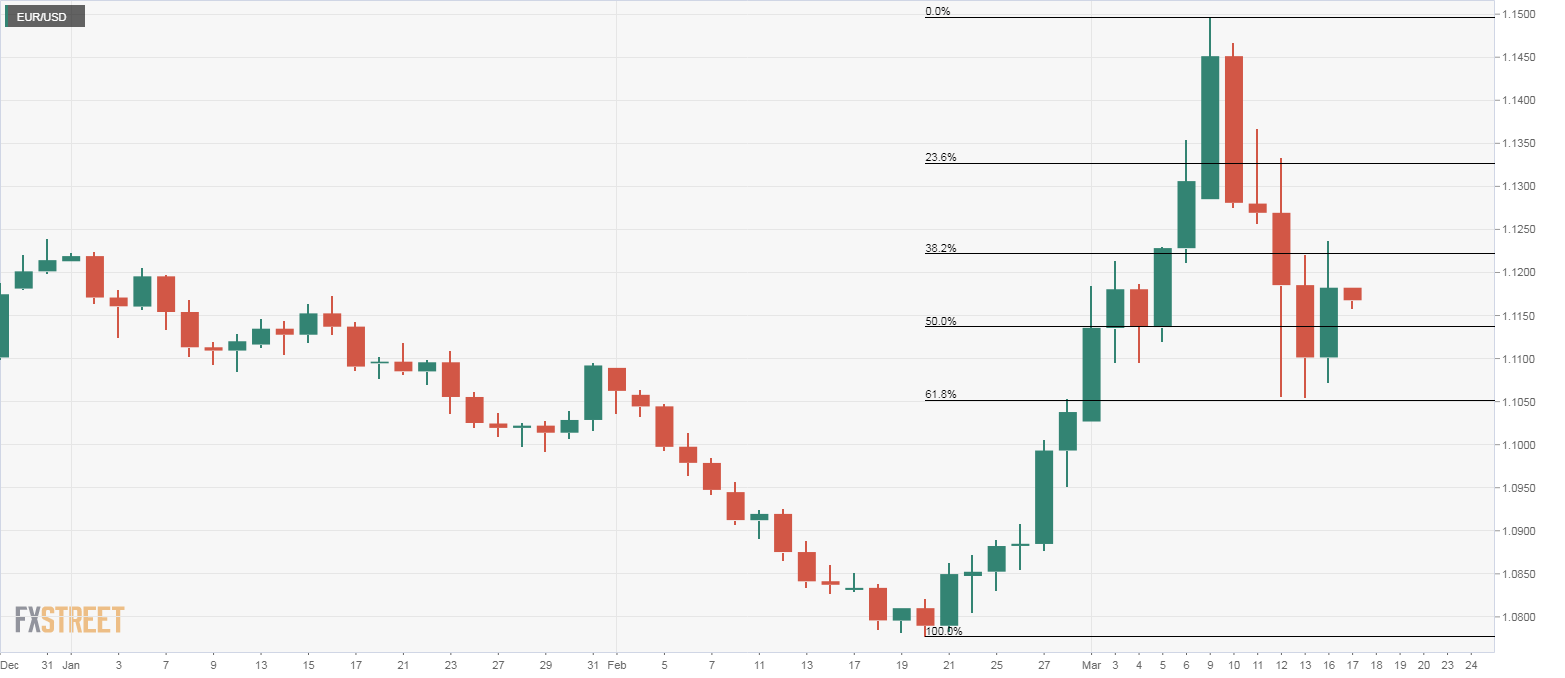

EUR/USD's pullback from recent highs near 1.15 looks to have ended with Monday's strong bounce from the key support and the spot could challenge the psychological resistance of 1.12.

On Monday, the pair found bids near 1.1052 - the 61.8% Fibonacci retracement of the rally from Feb. 20 low to March 9 high - and closed out with 0.69% gains. The Fibonacci support also held ground on Thursday and Friday.

The repeated bear failure to price support and the subsequent bounce has revived the immediate bullish setup. A break above 1.12 would open the doors to 1.1237 (Monday's high). A close higher would further confirm bullish revival and expose the recent high of 1.1495 (March 9 high).

Alternatively, a close under 1.1052 is needed to put the sellers into the driver's seat. The pair is currently trading at 1.1167, representing marginal gains on the day.

Daily chart

Trend: Bullish