Our best spreads and conditions

About platform

About platform

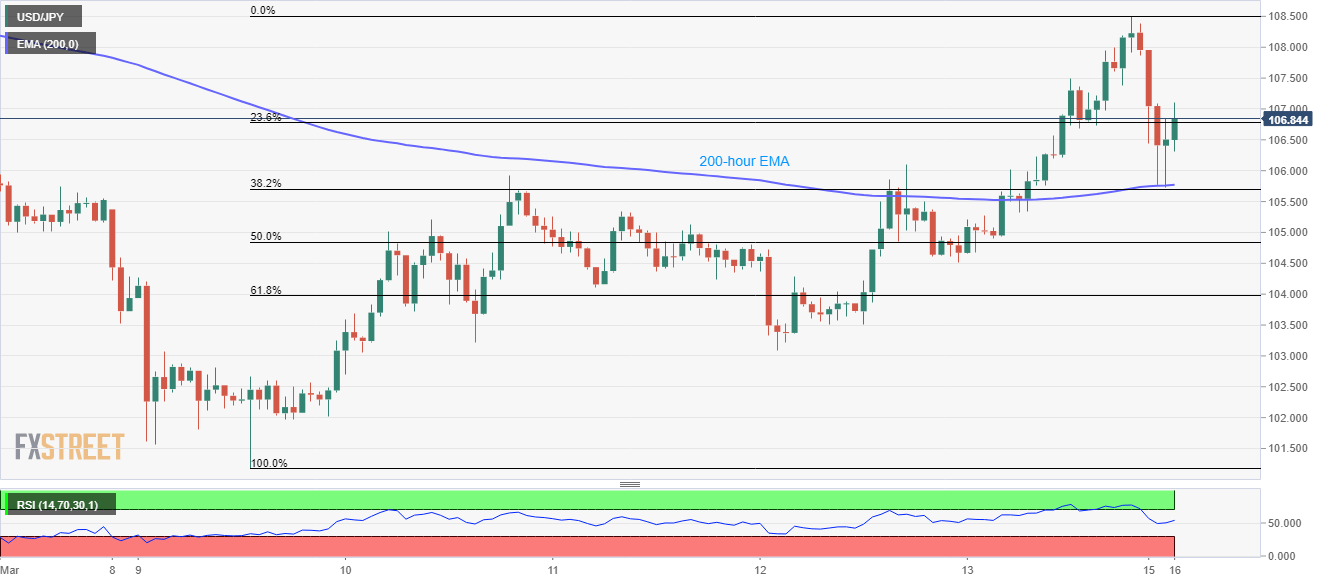

Following the BOJ’s announcement of the emergency meeting, USD/JPY recovers to 106.93 during the Asian session on Monday. In doing so, 38.2% Fibonacci retracement of its recovery from March 09 as well as 200-hour EMA seems to act as the strong immediate supports.

The pair earlier dropped after the Fed announced a surprise rate cut and a $700 billion worth of Quantitative Easing (QE) while ruling out this week’s FOMC meeting.

Also joining the league of global central bankers fighting to coronavirus (COVID-19) pandemic was the RBNZ that slashed benchmark rates by 0.75%.

With that, global investors anticipate BOJ to leap forward in saving the Japanese yen as traders show interest in the haven, making it stronger, amid the uncertain times.

During the pair’s further recovery, a 200-day SMA level of 108.25 and the recent high surrounding 108.50 hold the keys to early-February lows near 109.65/70.

Alternatively, a downside break below 105.75/70 support confluence can fetch the quote towards March 12 low near 103.00.

Trend: Recovery expected