USD/MXN Price Analysis: Mexican Peso seesaws amid oil weakness, Fed move

- USD/MXN struggles after recovering the early-day losses.

- Oil remains on the back foot amid coronavirus woes, Fed’s surprise rate cut and QE.

- Mexican banks are off due to Benito Juarezs Birthday, coronavirus headlines will be the key.

Despite recovering most of the early-day drop from 22.15 to 21.37, USD/MXN fails to extend the run-up while taking rounds to 21.90-22.00 during Monday’s Asian session.

Following a surprise Fed rate cut to 0.25% and $700 billion worth of Quantitative Easing (QE), the Fed Chair dashed hopes for negative interest rates. The Fed Jerome Powell, in his latest press conference, also said that the Fed is going to "go in strong" on asset purchases.

In addition to the Fed, RBNZ also announced its much-awaited rate cut while slashing the benchmark rate from 1.0% to 0.25%.

Amid all these moves, oil prices remained under pressure as coronavirus woes get sever in Italy and Spain. The latest updates suggest numbers in Italy and France crossed 24,747 and 5,400 levels respectively. The oil benchmark is currently down 8.08% to $30.60 by the press time.

Read: WTI Crude Oil tumbles toward $31 on shock Fed cut amid the coronavirus crisis

On the other hand, the US CDC recommends canceling all large in-person gatherings while US President Donald Trump pushed governors of states and local officers to step-up efforts towards driving up testing and testing sights.

Investors will keep eyes on the coronavirus (COVID-19) news/updates as well as global central bank co-ordinated moves, if any, for fresh impulse.

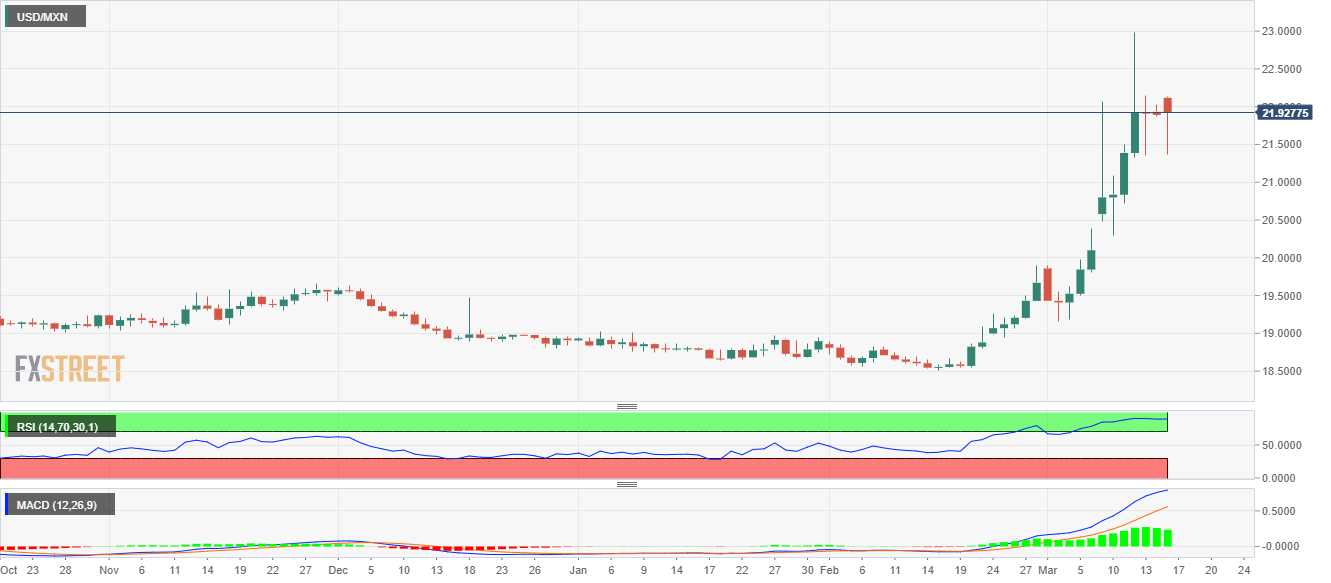

USD/MXN Forecast Chart

Buyers will look for a sustained move beyond 22.15 to take-out the monthly top surrounding 23.00. Alternatively, sellers shouldn’t look for entry unless USD/MXN prices slip back below June 2018 top close to 21.00.