Our best spreads and conditions

About platform

About platform

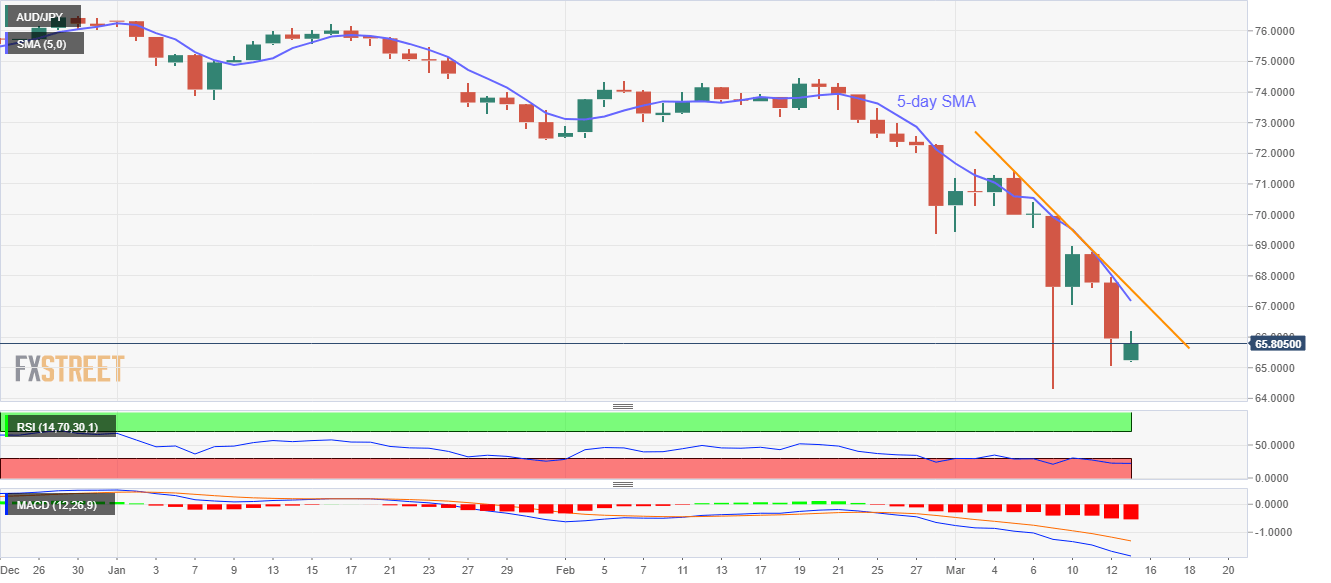

While snapping a two-day losing streak, AUD/JPY rises 0.80% to 65.80 amid the initial Asian trading session on Friday. In doing so, the pair registers a higher low technical pattern. Though, the quote’s sustained trading below short-term resistances keeps sellers hopeful.

Given the oversold RSI conditions extending its support, the quote can confront a 5-day SMA level around 67.15 during the further pullback. However, a short-term descending trend line since March 05, 2020, could limit additional recovery near 67.60.

Other than 5-day SMA and a short-term trend line resistance, the AUD/JPY prices will find February month low near 69.40 and 70.00 as extra upside barriers.

Alternatively, a downside break below 65.00 will negate the technical pattern and can recall the bears targeting 64.00 mark with the weekly low close to 64.30 likely being an intermediate halt.

If at all the bears keep dominating past-64.00, early February 2009 levels surrounding 62.00 can become their favorites.

Trend: Bearish