Back

12 Mar 2020

Crude Oil Futures: Downtrend resumed

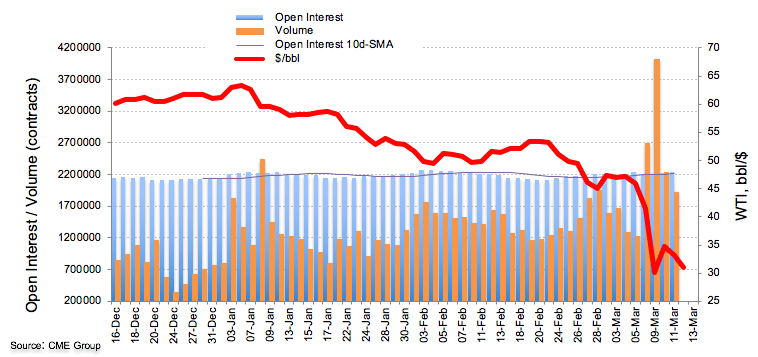

Traders added around 20.4K contracts to their open interest positions in crude oil futures markets on Wednesday, reaching the second build in a row as per advanced data from CME Group. In the opposite direction, volume went down for the second consecutive session now by around 318.5K contracts.

WTI could re-visit 2020 lows in sub-$28.00 levels

The barrel of WTI traded on the defensive on Wednesday amidst rising open interest, opening the door for the continuation of the leg lower in the near-term. That said, there is room for prices to re-test the area of YTD lows below the $28.00 per barrel.