Back

10 Mar 2020

USD/INR New York Price Forecast: Dollar easing from three-decades highs vs. rupee

- USD/INR bull trend remains intact as the market is off three-decades highs.

- A correction down cannot be ruled out.

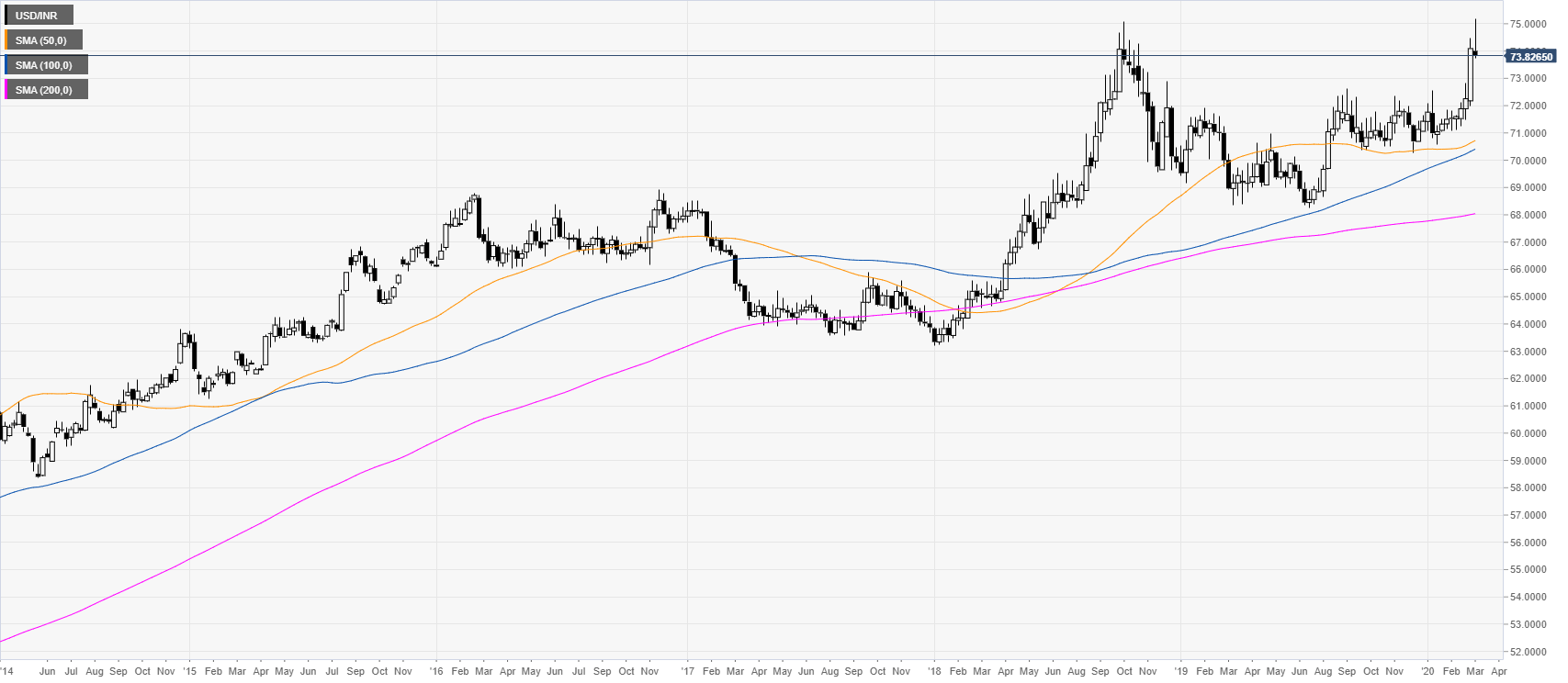

USD/INR weekly chart

USD/INR is trading above the main weekly simple moving averages (SMAs) while printing a fresh three-decade high at the 75.19 level.

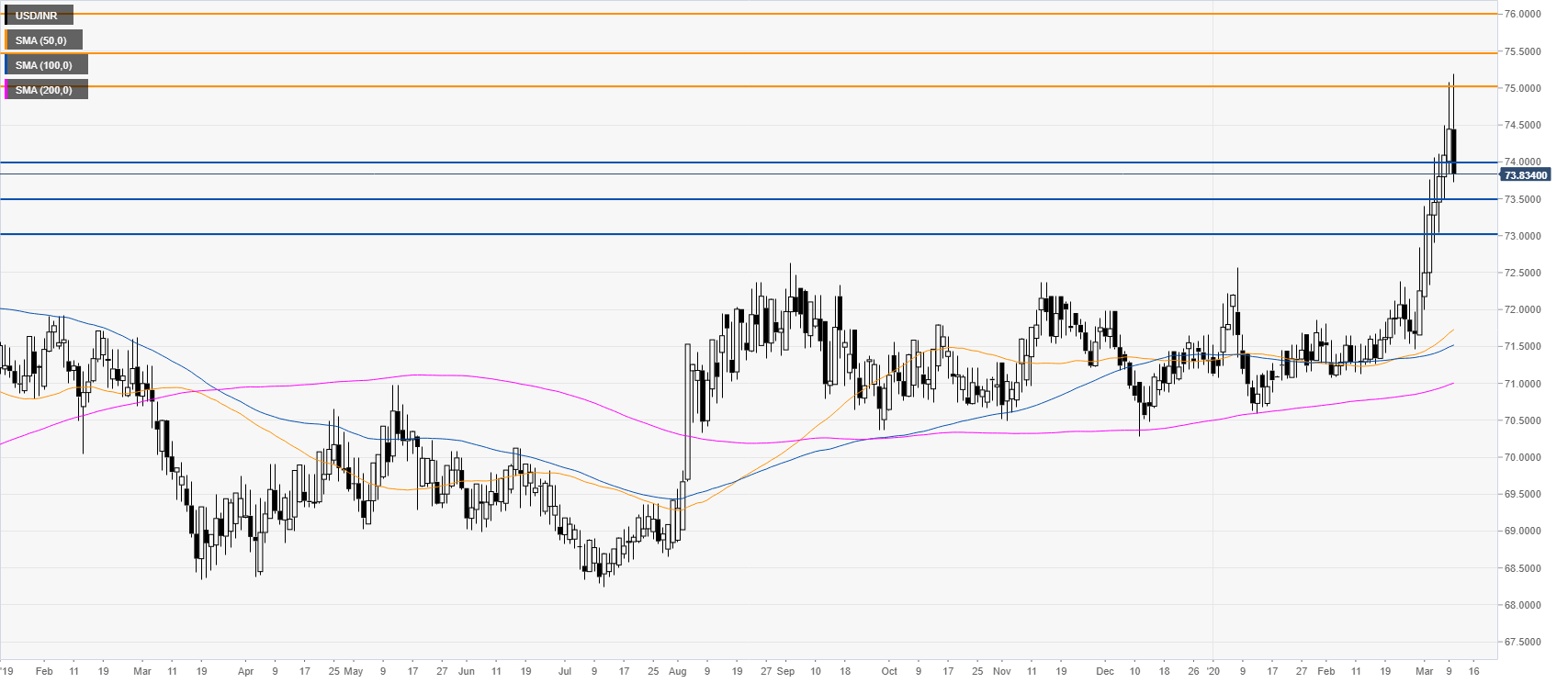

USD/INR daily chart

The spot is pulling back down from the 75.00 figure while challenging the 74.00 level. A daily close below the above-mentioned level could lead to a deeper retracement down towards 73.50 and 73.00 levels. Bulls would need to recapture the 75.00 resistance to travel in uncharted territories.

Additional key levels