Our best spreads and conditions

About platform

About platform

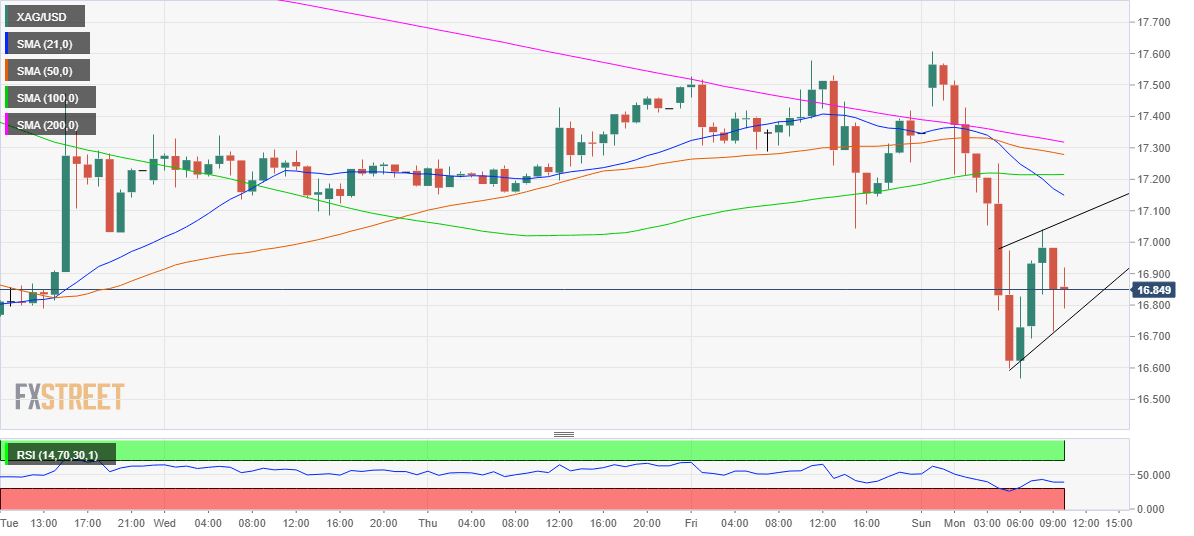

Silver (XAG/USD) prices are seen rebounding from a fresh five-day low of $16.56 reached in early Europe. However, the bounce continues to face stiff resistance just above the $17 mark.

In the Asian opening trades, the precious metal hit the highest in six days at 17.60, tracking the rally in Gold prices. The yellow metal topped $1700 earlier today amid a massive flight to safety, fueled by the heightening fears over the coronavirus outbreak and oil-price plunge.

The XAG bears then took over control as the oil slump exacerbated the market chaos and intensified fears over the global economic growth, which eventually rendered negative for the industrial metal, silver.

Silver prices have charted a potential bearish pennant formation on the hourly chart, which is usually a bearish continuation pattern. Therefore, a test of the 16 level cannot be ruled if the pattern is validated on a break below the pennant support near 16.70. The hourly Relative Strength Index (RSI) trades below the midline around 40 and has further room southwards, suggesting the path of least resistance appears to the downside. Adding to the bearish momentum, the price trades below all the major hourly Simple Moving Averages (SMAs).

On the flip side, only a sustained break above the pennant resistance of 17.06 will bump up the recovery momentum towards the bearish 21-hourly SMA at 17.15. The next resistances are aligned at the horizontal 100-hourly SMA of 17.22 and 17.30, the confluence of the 50 and 200-hourly SMAs.