Our best spreads and conditions

Learn more

Learn more

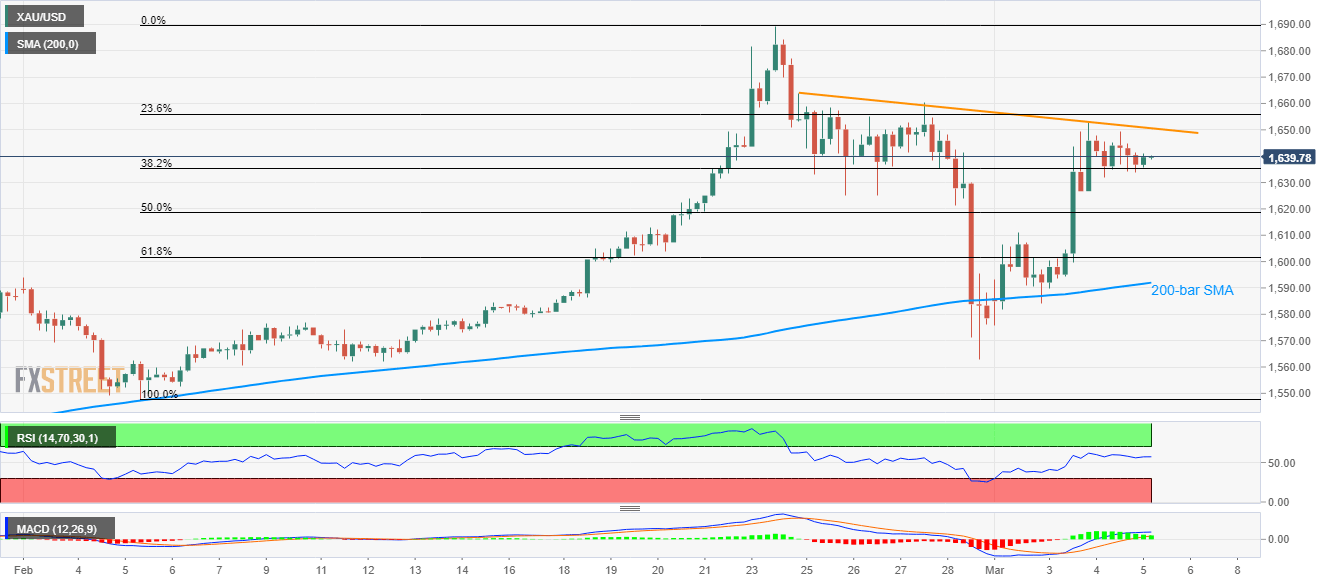

Despite repeated failures to take-out a short-term resistance trend line, Gold prices remain 0.07% positive while taking rounds to $1,640 during the pre-European session on Thursday.

That said, the yellow metal is forming an inverse head-and-shoulder bullish pattern on the four-hour (H4) chart that needs confirmation with a break of the neckline, currently at $1,651.

In doing so, the bullion is theoretically capable of targeting $1,750. However, it’s expected to take a rest near the latest high of $1,690 before rising further.

On the downside, 50% and 61.8% Fibonacci retracement of the bullion’s February month rise, around $1,618 and $1,602 respectively, will offer intermediate supports during the U-turn.

Additionally, 200-bar SMA near $1,592 and February-end bottom near $1,563 will be tough nuts to crack for the sellers past-$1,602.

Trend: Bullish