Our best spreads and conditions

About platform

About platform

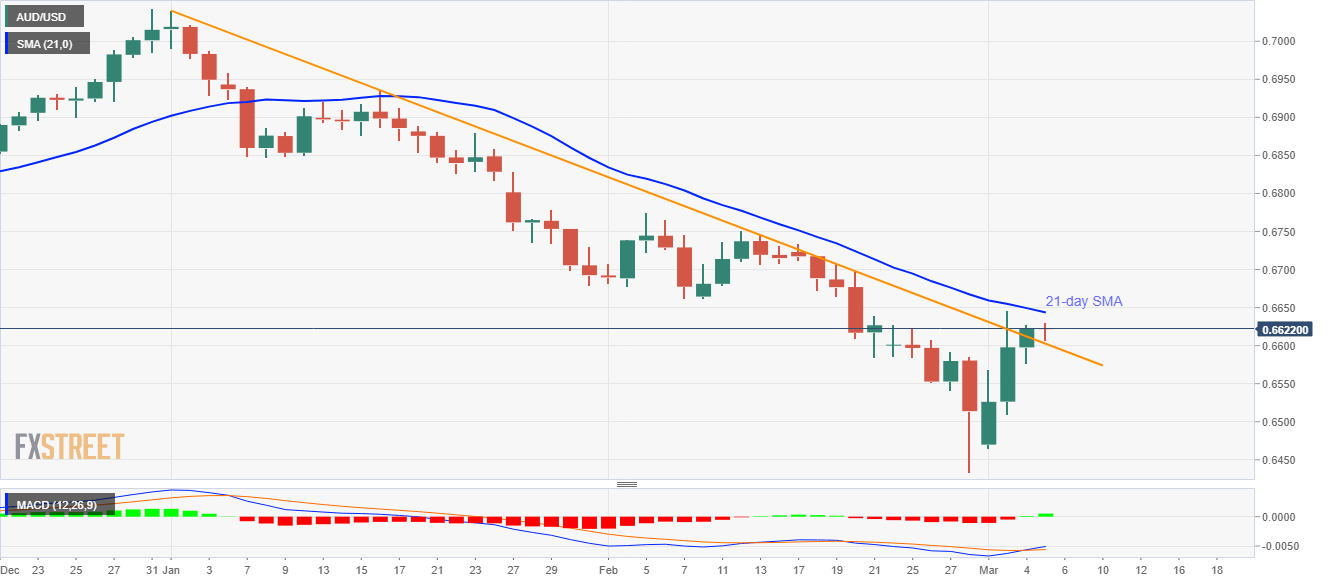

AUD/USD registers modest gains to 0.6625 during the initial trading session on Thursday. The pair recently cleared a downward sloping trend line since January 01, 2020, with MACD turning bullish for the first time in two weeks.

Even so, a 21-day SMA level of 0.6645 questions the short-term buyers, a break of which could escalate the recovery moves towards early February lows surrounding 0.6660.

If at all Aussie prices manage to remain positive past-0.6660, 0.6700 and the previous month top surrounding 0.6775 will return to the chart.

Alternatively, pair’s declines below resistance-turned-support, around 0.6600, will need validation from a sustained downtick of 0.6585.

In doing so, sellers can take aim at 0.6525 and 0.6500 ahead of targeting the multi-year bottom close to 0.6430.

Trend: Further recovery expected