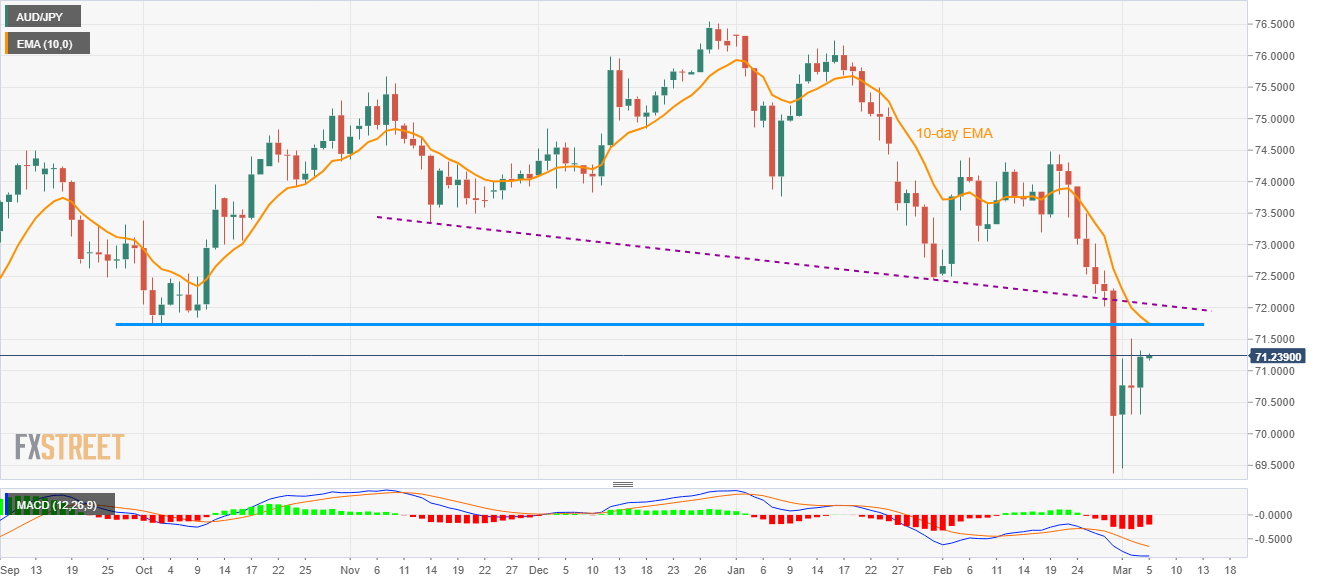

AUD/JPY Price Analysis: 10-day EMA, October 2019 low guard immediate upside

- AUD/JPY stays positive while extending the previous day’s gains.

- A descending trend line from November 2019 adds to the resistance.

- Bearish MACD will gain sellers’ attention on the downside break of 70.30.

AUD/JPY gains 0.06% to 71.25 during the early Thursday’s Asian session. In doing so, the pair holds onto its recovery from a multi-year low while rising towards a confluence of October 2019 low and 10-day EMA.

Other than 71.70/75 immediate resistance confluence, a downward sloping trend line since November 2019, at 72.05 also acts as the key upside barrier for the pair.

Should there be a clear run-up beyond 72.05 on a daily closing basis, the quote gets the power to challenge the early-February lows near 73.05.

Alternatively, 70.30 and 70.00 could entertain short-term sellers ahead of highlighting the importance of March 2009 levels surrounding 68.50 as supports.

It’s worth mentioning that the MACD is flashing bearish signals and hence any more upside should be watched with caution.

AUD/JPY daily chart

Trend: Pullback expected