Back

4 Mar 2020

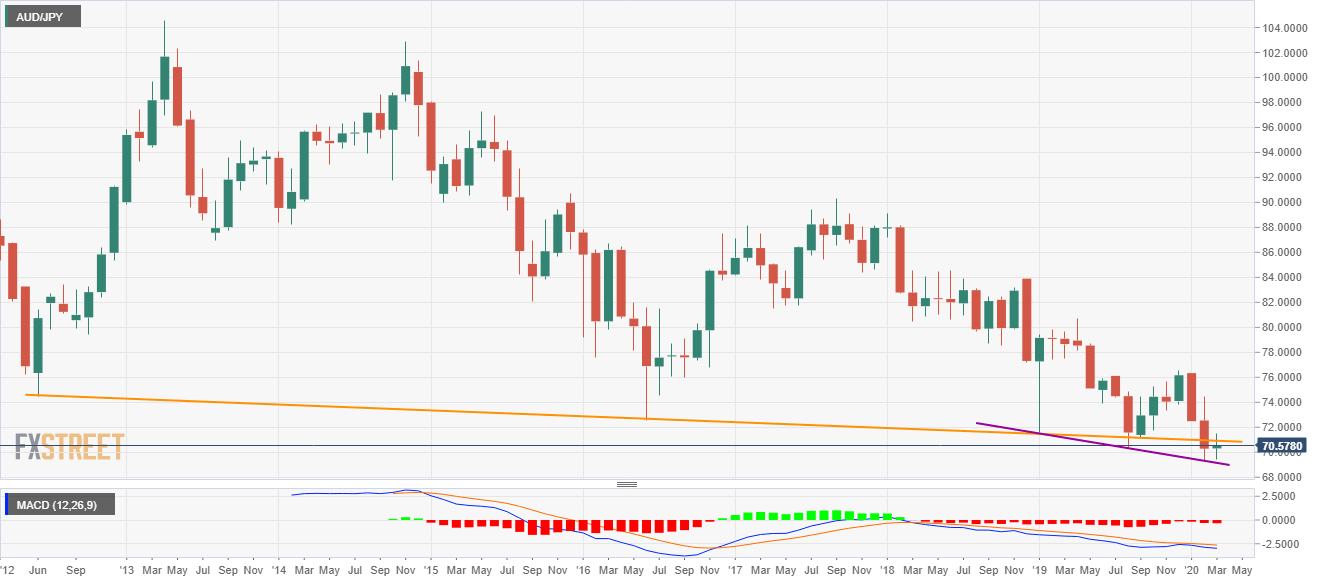

AUD/JPY Price Analysis: Weak below multi-year-old support-turned-resistance

- AUD/JPY remains under pressure below the key resistance (previous support).

- April 2018 low lures the bears, bulls need to stay strong beyond January's bottom.

- Bearish MACD signals further declines, a 15-month-old support line gains immediate attention.

AUD/JPY remains on the back foot around 70.59 by the press time of Wednesday’s Asian session. In doing so, the pair remains below the longer-term trend line stretched from June 2012.

Not only it's sustained trading below the key resistance, but bearish MACD also signals the pair’s weakness.

As a result, sellers can take aim at 70.00 round-figure and a downward sloping trend line since January 2019, at 69.15 now, during the pair’s further downside.

Alternatively, a sustained break of the support-turned-resistance, at 70.93 now, can trigger fresh recovery moves to October 2019 bottom close to 71.75.

However, buyers should remain cautious until the quote closes beyond January month low of 72.44.

AUD/JPY monthly chart

Trend: Bearish