Our best spreads and conditions

About platform

About platform

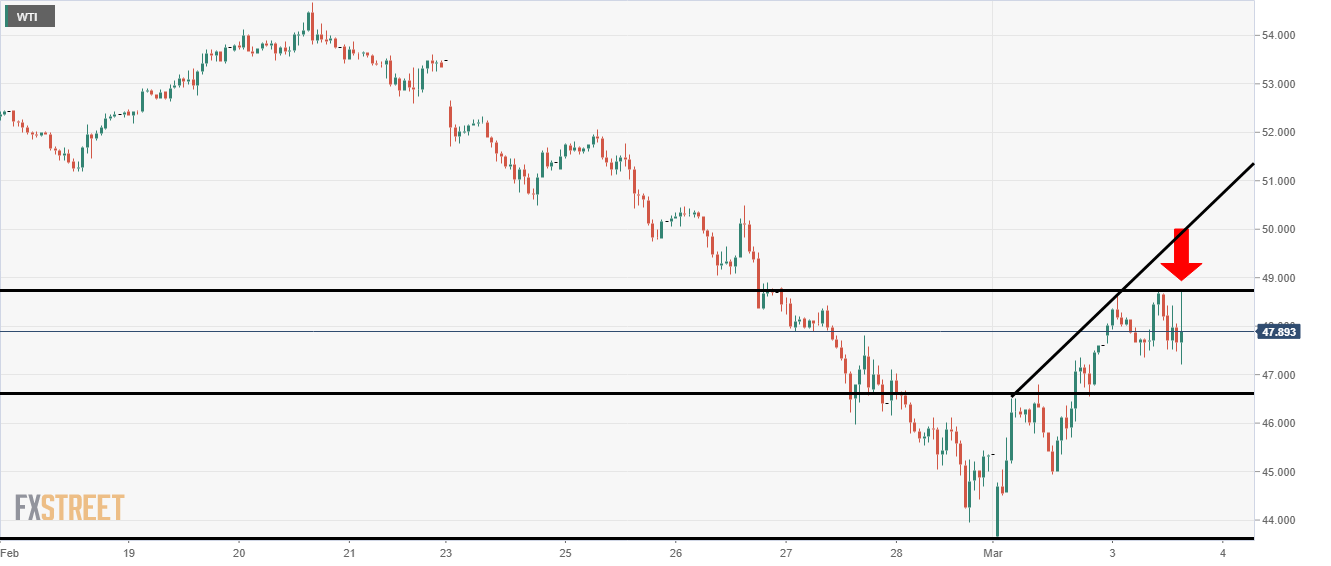

In an initial reaction spot WTI rose around 2.23% to the Fed rate cut announcement.

Now the commodity has pulled back somewhat to trade near $48/bbl.

Interestingly, the price could not take out the previous wave high of $48.74/bbl.

The market must remember that the OPEC+ meeting will be taking place on Thursday and Friday this week.

OPEC+ delegates may also be looking to take some kind of emergency measures due to the outbreak of the coronavirus.

If the level does break to the upside the next resistance could be at the $50/bbl psychological level and above that $51.22/bbl where the price found some support in the past.