Back

3 Mar 2020

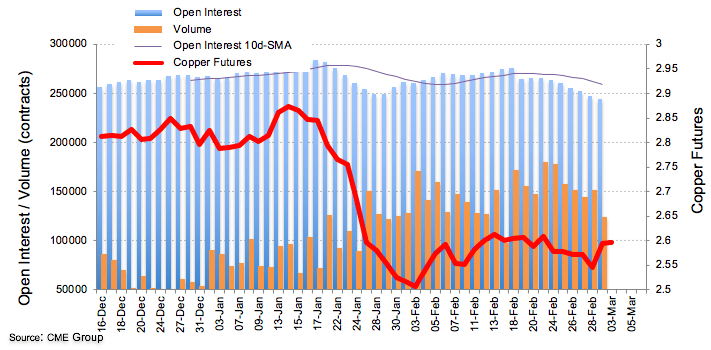

Copper Futures: Recovery could run out of steam soon

Traders scaled back their open interest positions in Copper futures markets by around 2.5K contracts on Monday, clinching the sixth consecutive pullback in light of advanced data from CME Group. In the same line, volume resumed the downside and shrunk by nearly 28.2K contracts,

Copper faces a tough resistance at 2.6250

Short covering was behind Monday’s uptick in prices of the base metal, as showed by declining open interest and volume coupled with the uptick in prices. That said, the ongoing recovery is expected to struggle around recent tops in the key resistance area near 2.6250.