Our best spreads and conditions

About platform

About platform

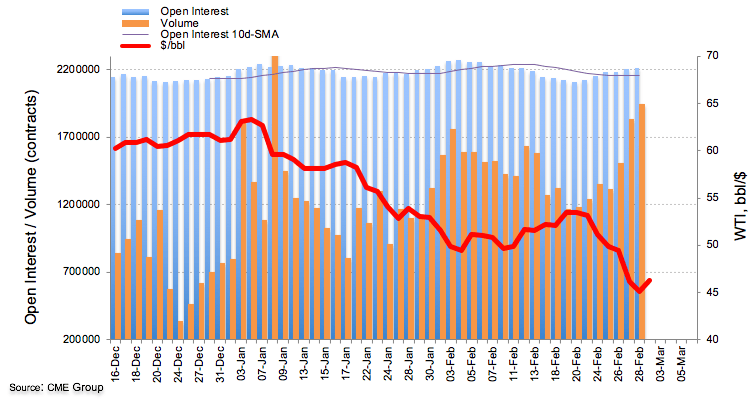

Open interest in crude oil futures markets rose for the sixth consecutive session on Friday, now by around 3.5K contracts. In the same direction, volume went up for the third straight day, now by around 116.8K contracts, all according to flash readings from CME Group.

Prices of the barrel of WTI dropped to sub-$44.00 levels on Friday, recording at the same time fresh 2020 lows amidst rising open interest and volume. Against this, further downside remains well on the cards and any occasional bullish attempt should be considered as corrective only.