Back

28 Feb 2020

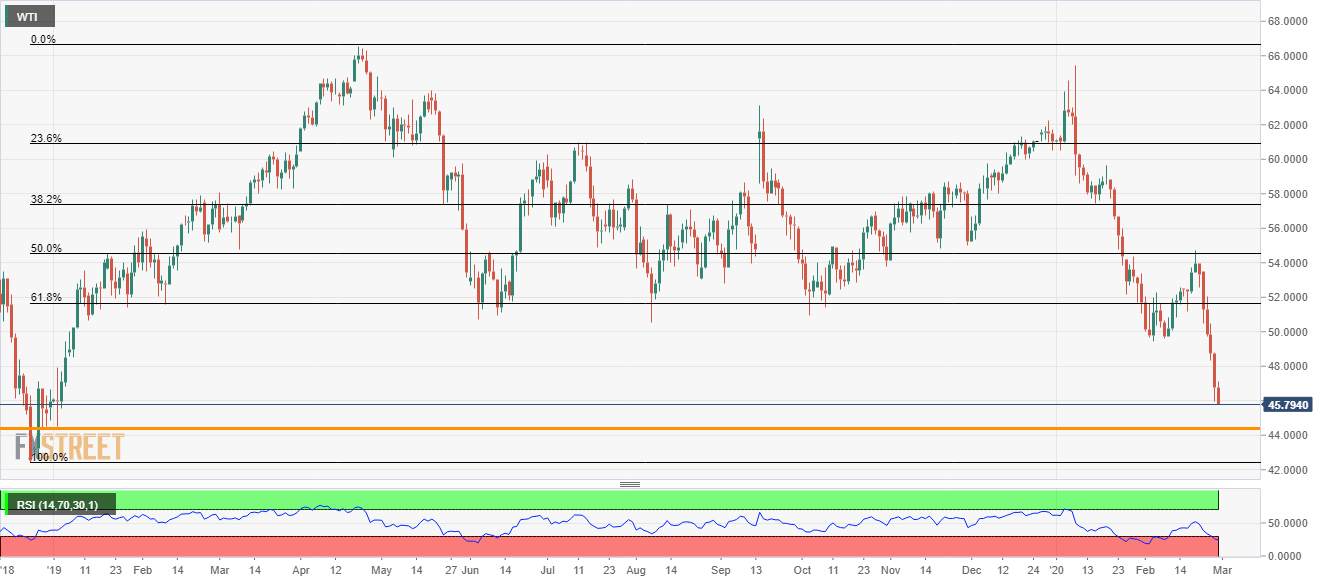

WTI Price Analysis: Bears break $46.00 to refresh 13-month low, focus on $44.50

- WTI bears keep dominating near the lowest level since early-January 2019.

- Failures to register pullback, a sustained trading below the initial monthly bottom keeps sellers hopeful.

WTI drops to $45.86, down 1.92%, during the early Friday. In doing so, the oil benchmark tests the lowest since January 02, 2019.

Given the quote’s sustained trading below near-term key resistances, coupled with failures to bounce, keep bears directed towards the lows marked during 2019 as well as December 27, 2018, around $44.50.

Should energy bears fail to ignore oversold RSI conditions and dominate below $44.50, December 2018 bottom close to $42.50/45 will be on their radar.

Meanwhile, bulls are less likely to enter below February 05 low of $49.44, a break of which could push oil prices towards 61.8% Fibonacci retracement of the upside between December 2018 and April 2019, around $51.65.

WTI daily chart

Trend: Bearish