Back

26 Feb 2020

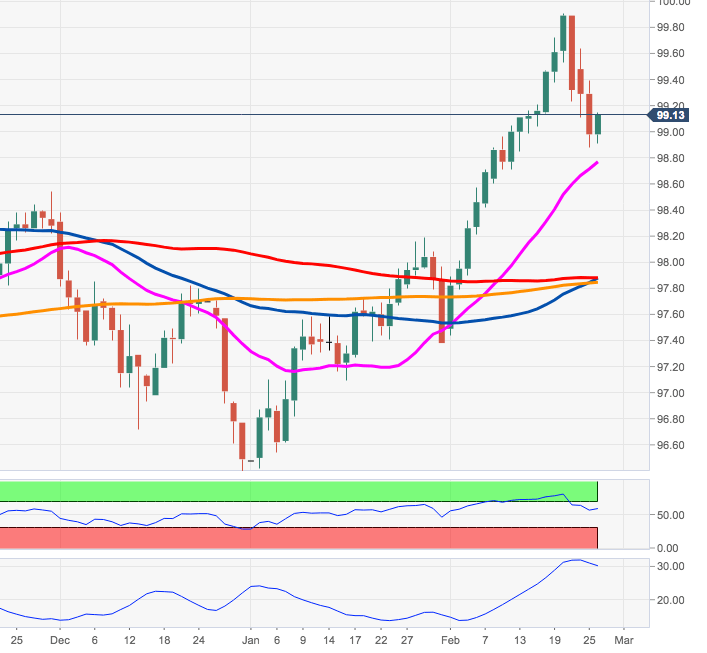

US Dollar Index Price Analysis: Further downside could test 98.50/60

- DXY briefly dropped below the 99.00 support on Tuesday.

- Decent support is expected to emerge in the 98.50/60 band.

DXY tested the sub-99.00 area on Tuesday, recording at the same time fresh multi-day lows.

The corrective downside could extend to the 98.54/58 band, where coincide the November’s top and a Fibo retracement of the 2020 rally.

Looking at the broader picture, the dollar’s outlook remains constructive while above the 200-day SMA, today at 97.82.

DXY daily chart