Back

25 Feb 2020

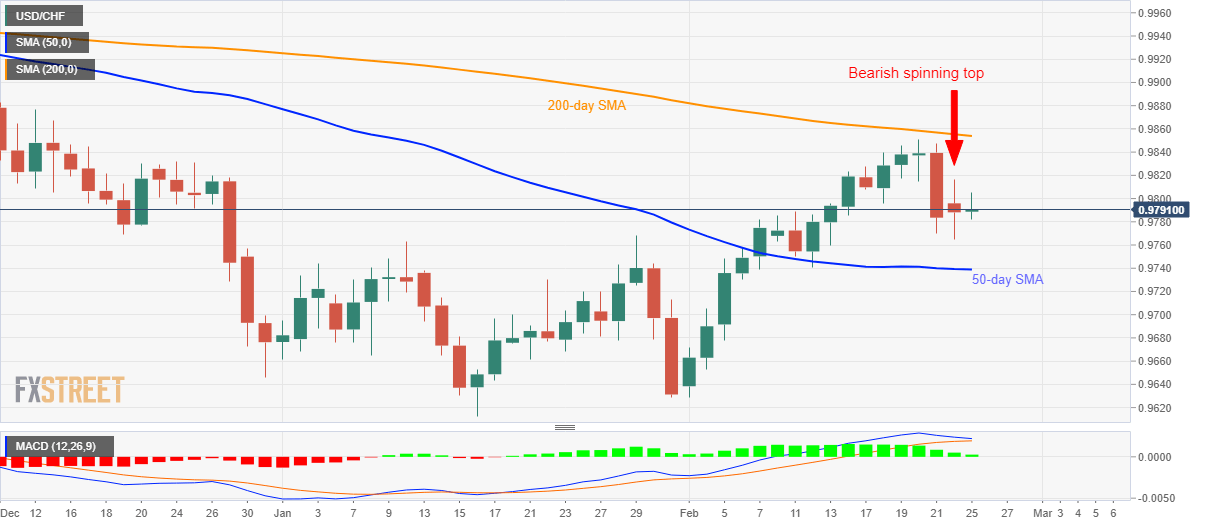

USD/CHF Price Analysis: Bearish spinning top keep sellers hopeful

- USD/CHF snaps two-day losing streak.

- Bearish candlestick formation, sustained trading below 200-day SMA favor further selling.

- Bullish MACD, 50-day SMA question the bears.

USD/CHF registers fewer moves while trading around 0.9790 during the pre-European session on Tuesday. The daily chart forms a bearish candlestick pattern but bullish MACD and 50-day SMA could limit further declines.

That said, the bears will be more powerful to aim for 0.9700 if breaking a 50-day SMA level of 0.9740 on a daily closing basis.

During the quote’s further declines below 0.9700, the month-start top near 0.9670 and the January month bottom surrounding 0.9612 can offer intermediate halts to 0.9600 round-figure.

Alternatively, the pair’s rise beyond Monday’s top of 0.9816 negates the bearish candlestick formation, which in turn could trigger the quote’s recovery targeting a 200-day SMA level of 0.9854.

USD/CHF daily chart

Trend: Sideways